FTSE 100 remained range-bound in the week ended 2 July. Here we are giving the roundup of gainers and losers of every day during the passing week.

28 June 2021: MONDAY

Top riser:

- AstraZeneca Plc (LON: AZN): Pharmaceutical giant closed at GBX 8,666 for the, up by 1.96% with a day high of GBX 8,691 after the company informed that the trials of Vaxzevria Covid-19 demonstrated strong immunity up to one year after just one dose and was effective against all variants of coronavirus. Also, the company’s Forxiga medicine used to treat chronic kidney diseases got recommended for approval in the European Union (EU).

Top faller:

- Burberry Group Plc (LON: BRBY): Stock of luxury goods maker was down by 8.67% at GBX 2,055 with a day’s low of GBX 2,024 following the announcement of its current CEO Marco Gobbetti stepping down at the end of 2021. Marco Gobbetti played an important role in the transformation of Burberry’s brand and business.

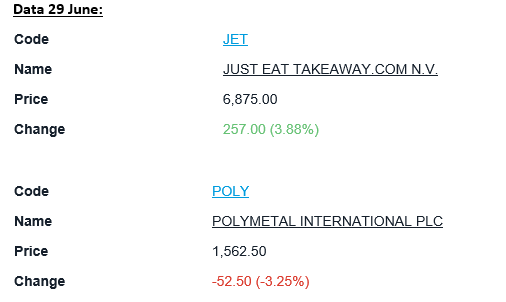

29 June 2021: TUESDAY

Top riser:

- Just Eat Takeaway (LON: JET), the online food delivery marketplace, closed at GBX 6,875 for the day, up by 3.88%, with a day’s high of GBX 6,880. The boost was due to positive investors’ sentiments and expectations of higher-order flow during the ongoing EURO Championship, especially during the England-Germany match at the Wembley Stadium. Just Eat Takeaway is one of the official partners of the EURO Championship.

Top faller:

- Polymetal International Plc (LON: POLY), the precious metal and mining stock, closed the day in red at GBX 1,562.5, down by 3.25% with a volume of 1.47 million shares. The miner company’s stock was down following the gold price fall, which recorded the worst monthly performance in the last five years.

30 June 2021: WEDNESDAY

Top riser:

- Compass Group Plc (LON: CPG), the food and catering service provider’s stock, closed at GBX 1522, up by 1.91%, with a day high of GBX 1,529. 9 million shares were traded on the exchange. The stock traded higher as investors expect the company’s third-quarter results to be strong with margin improvement.

Top faller:

- Prudential Plc (LON: PRU), the asset management company’s stock, was down by 3.61% for the day and closed at GBX 1,373.5, with a day’s low of GBX 1,361 and a volume of 4.8 million shares. The stock was down primarily because of profit booking by investors after the company was given a neutral rating by JP Morgan & Co. with a limited upside target.

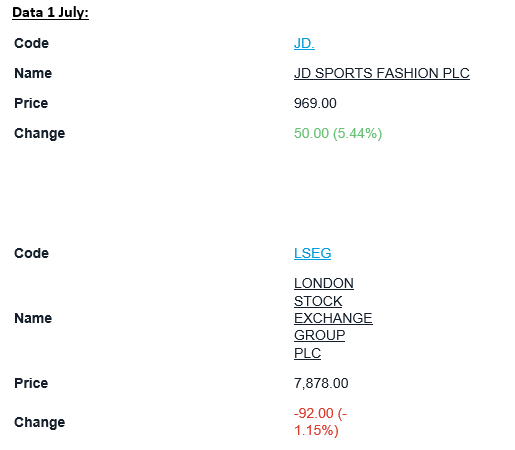

1 July 2021: THURSDAY

Top riser:

- JD Sports Fashion Plc (LON: JD.), the retail fashion store operator stock, closed at GBX 969 for the day, up by 5.44%, with a volume of 1.84 million shares after the company forecasted better pretax profits for the full year. The company also informed full disposal of Sports Unlimited Retail BV, which is based in the Netherlands.

Top faller:

- London Stock Exchange Group Plc (LON: LSEG), the stock was down by 1.15% for the day at GBX 7,878, with the day low of GBX 7,812, following the profit booking by investors. Many investors are concerned that the company’s future costs will be higher because of transformation towards data analysis and system upgrades.

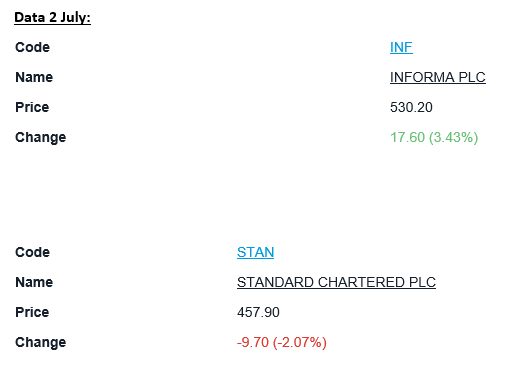

2 July 2021: FRIDAY

Top riser:

- Informa Plc (LON: INF), the stock of events and exhibitions organiser, was up by 3.36% at GBX 529.8 with a day high of GBX 531.8. There was a buy rating for the stock, with the expectation that Informa Plc may report recovery in profitability once the large trade shows start being conducted globally.

Top faller:

- Standard Chartered Plc (LON: STAN), the financial service provider stock, was down by 2.18% at GBX 456.30, with a day low of GBX 456.0. The company’s stock saw profit booking by investors after an intraday high of GBX 466.10.