Highlights

- Global Investors are returning to London stock Exchange once again as the UK listed companies are available at attractive valuations compared to global peers.

- Ted Baker is focusing on new products and had launched a new collection towards the end of last year.

The UK stocks market’s recent rally and good returns to investors indicate that the London Stock Exchange-listed companies are finally back on the investment radar of the global investors. There has been a significant recovery after the pandemic, and the economy is almost back at pre-pandemic levels as per the key economic indicators like GDP growth rate and inflation.

Blue-chip index FTSE100 has given year to date (YTD) return of 8.62%, while mid-cap focused FTSE250 index delivered a 17.80% return to investors. Investment experts believe the UK-listed companies are still available at attractive valuations compared to other markets.

Mergers and takeovers offer for UK-based companies is another important aspect that has contributed to the stock market rally. Merger and Acquisitions activity in the UK is at a record high, with 124 takeover bids so far worth £41.5 billion.

Let us look at 2 FTSE listed stocks that could be a potential buy opportunity:

Ted Baker Plc (LON:TED)

The company engages in the retailing of clothes and accessories. It primarily has operations in the UK and Europe, and it also supplies its products to stores operated by license partners globally. At present, the company has a chain of over 500 stores worldwide.

Why invest in Ted Baker Plc?

Ted Baker Plc operations were impacted due to the Covid-19 pandemic as most of its shops remain closed due to lockdown. As a result, its revenue was down by 44.2% at £352 million during the 53-weeks ended 30 January 2021.

But the company has taken some steps that could result in a significant rise in revenues in the coming quarters:

- New products and Brand: The company continues to focus on new products and had launched a new collection towards the end of last year, which received a positive response. The company plans to improve its product proposition and increase its stores’ counts in strategic markets.

- Growth in digital presence: The company saw good progress in eCommerce sales during the pandemic period and is likely to see further improvement going forward. The company plans to drive its digital development by completing an eCommerce re-platform launch.

- Significant cost cutting: The company expects to save £31 million per annum ahead of the previous guidance. Also, the company will continue to make property cost reductions with rent savings of at least 15% through rent renegotiations.

The company has set the above target and is firm on achieving the same as part of its transformation plan. If the company managed to achieve the same, that could lead to a significant revenue revival, which would reflect in the company’s stock price.

Ted Baker Plc currently trades at GBX 168.20, up by 9.29% on 6 September 2021 at 9.57 am GMT+1 with a market cap of £284.11 million.

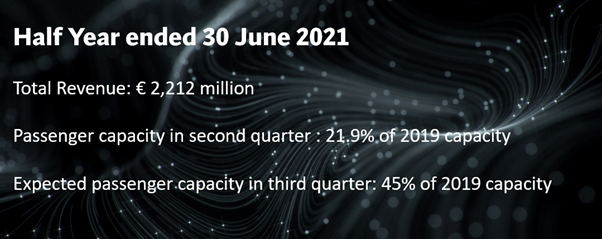

International Consolidated Airlines Group (LON: IAG)

The company engages in passenger and cargo services and operates through various brands. The airline company has a worldwide presence and cover all major destinations.

IAG Group, which is the owner of British Airways, is likely to get good support with the lifting of travel restrictions globally and could act as a trigger for growth in revenue and share price.

The company witnessed a revival in passenger traffic as soon as some travel restrictions were lifted, indicating these trends to continue in the near future due to pent-up travel demand, higher household savings, and people’s willingness to travel after lockdown.

© 2021 Kalkine Media Ltd.

IAG Group currently trades at GBX 156.64, up by 0.54% on 6 September 2021 at 10:03 am GMT+1 with a market cap of £7,729.14 million.

.jpg)