UK shares traded in negative territory in the afternoon deals after opening lower on Wednesday, 14 October 2020, tracking the global cues, lower Wall Street closing, rising worries due to the pause in Covid-19 vaccine trials and the ongoing Brexit negotiations. Just Eat Takeaway, Kingfisher Plc, Berkeley Group Holdings Plc, Lloyds Banking Group Plc, AstraZeneca Plc and Rolls-Royce Holdings Plc were among the major stocks in the limelight.

The benchmark FTSE 100 made an intraday high of 6,009.81, up 0.67 per cent and recorded the day’s bottom at 5,932.47, down 0.62 per cent from the previous close of 5,969.71. We take a look at the top 10 market movers of the day.

Just Eat Takeaway.Com.NV (LON: JET)

The shares of Amsterdam-headquartered online food delivery services company Just Eat Takeaway marked the biggest gain among the FTSE 100 constituents on Wednesday, after the firm reported a spurt in the online orders in the third quarter as a large section of people fulfilled their respective food requirements through online channels adhering the social distancing norms and various other restrictions in place.

The stock price of Just Eat Takeaway rose as much as 5.52 per cent to £9,330, after making an intraday high at £9,410, up 6.42 per cent from the previous close of £8,842. About 112,434 shares of Just Eat Takeaway exchanged hands until 12:25 pm on Wednesday. Providing the Q3 2020 update, Just Eat Takeaway said the company’s food order book swelled by 46 per cent in the third quarter ended on 30 September 2020 as compared to the same period last year.

(Source: Refinitiv, Thomson Reuters)

Kingfisher Plc (LON: KGF)

The stock of the London-headquartered retailer Kingfisher plc was the second-biggest gainer amid the FTSE 100 constituents in the early morning trades on Wednesday. Kingfisher share price rallied 3.19 per cent to £317.50 after registering a day’s high at £319.50, up 3.83 per cent from the previous close of £307.70. Until 12:40 pm, nearly 3.27 million shares of Kingfisher exchanged hands on the bourse.

Berkeley Group Holdings Plc (LON: BKG)

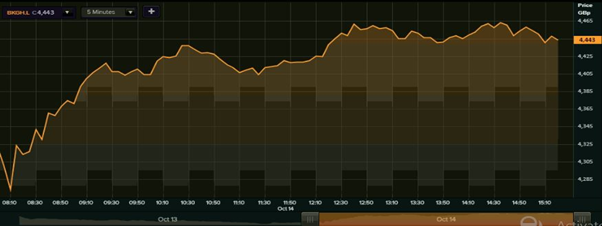

Berkeley Group Holdings share price soared more than 3 per cent after the Cobham-headquartered property developer said that it would return a whooping £1 billion to the respective shareholders over the period of next two years. The stock of Berkeley Group Holdings advanced 3.08 per cent to £4,455 on Wednesday, after hitting an intraday high at £4,465, up 3.31 per cent from the previous close of £4,322. About 110,016 shares of Berkeley Group Holdings were traded up until 13:06 pm today.

Bunzl Plc (LON:BNZL)

Shares of the London-based distribution and outsourcing firm Bunzl also made it to the top gainers among the FTSE components on Wednesday. The stock of Bunzl jumped 2.82 per cent to £2,625 after soaring as much as 6.15 per cent to a day’s high of £2,710. Bunzl share price had closed at £2,553 on Tuesday, 13 October 2020. About 1.53 million shares of Bunzl exchanged hands until 13:13 pm today.

Lloyds Banking Group Plc (LON: LLOY)

Shares of London-headquartered financial major Lloyds Banking Group were the volume toppers amid the FTSE 100 constituents on Wednesday. More than 43 million equity shares of Lloyds Banking Group were traded until 13:19 pm, translating into a total turnover of £6.67 million. However, Lloyds Banking Group share price was little changed at £26.95, up 0.30% from the previous close of £26.87. The stock of Lloyds Banking Group made an intraday high and low at £27.28 and £26.78, respectively.

Rolls-Royce Holdings Plc (LON: RR.)

Shares of the London-headquartered automaker and engineering firm Rolls-Royce Holdings plunged as much as 5.52 per cent to a day’s bottom of £173 on Wednesday. The jet engine-maker has been reeling under immense pressure due to the sluggish demand amid the Covid-19 pandemic-laden business activity. Recently, Rolls-Royce Holdings has unveiled its plans for a mega rights issue to the tune of £2 billion. Shares of Rolls-Royce Holdings also stood amid the top movers with a trading volume of 8.65 million until 13:33 pm.

Standard Chartered Plc (LON: STAN)

Shares of the London-headquartered banking and financial services giant Standard Chartered were the biggest laggards amid the FTSE 100 constituents on Wednesday. The stock of Standard Chartered dropped 4.82 per cent to £353.50 after sliding to a day’s low of £352, down 5.22 per cent from the previous close of £371.40. On the volume’s front, about 3.05 million shares of Standard Chartered exchanged hands until 13:41 pm.

JD Sports Fashion Plc (LON: JD.)

Shares of the Bury-based sports apparel-maker JD Sports Fashion advanced 3.29 per cent to £809.60 after making a day’s high at £810.4, up 3.39 per cent from the previous close of £783.80. JD Sports Fashion, while announcing the interim results for the 26 weeks to 1 August 2020, said the company has significantly managed to retain the sales through an unprecedented period of global turbulence and transient store closures resulting from the COVID-19 pandemic. JD Sports and Fashion anticipates delivering a headline profit before tax for the full year of at least £265 million, the company further said.

AstraZeneca Plc (LON: AZN)

Shares of Cambridge-headquartered drugmaker and pharmaceuticals major AstraZeneca were in the limelight on Wednesday after the Covid-19 vaccine trial hit a roadblock. The stock of AstraZeneca fell 2.01 per cent to £8,286, after registering a day’s bottom at £8,276, down 2.12 per cent from the previous closing price of £8,456 a piece. Witnessing a relatively high trading volume, about 563,598 shares exchanged hands on the bourse until 14:09 pm.

Compass Group Plc (LON: CPG)

Shares of the Chertsey-based contract food services firm Compass Group were the second-biggest fallers amid the FTSE 100 components on Wednesday. The stock of Compass Group dived 2.10 per cent to £1,189.50 after making an intraday low of £1,184.5, down 2.51 per cent from the previous closing of £1,215. The share price of Compass Group started the day in positive territory, largely unchanged at £1,215.50, before making a day’s peak at £1,225.50. Over a million shares of Compass Group exchanged hands on the bourse until 14:20 pm today.