EVRAZ Plc

Evraz Plc (EVR) is a vertically integrated steel company that carries out the production of steel, coal and vanadium products. The company has differentiated its operations in three operating segments: Steel segment; Coal segment; Steel, North America segment and Other Operations. It also operates production assets in Russia, the US, Canada, Czech Republic, Italy, South Africa, Ukraine and Kazakhstan.

Recent News

The company emphasised its commitment to higher standards of ethical business conduct in its Modern Slavery Transparency Statement for FY18. The company has made significant efforts in being fair and transparent. Any means of modern slavery such as child labour, bonded labour, human trafficking is strictly prohibited in all group companies.

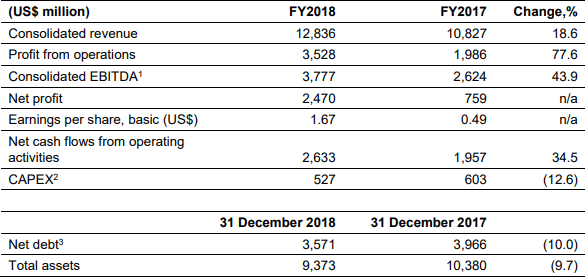

Financial Highlights for Financial Year 2018 (US$, million)

(Source: Annual Report, Company Website)

The companyâs consolidated revenue surged by 18.6 per cent to $12,836 million as compared with the financial year 2017 of $10,827 million, due to an increase in prices for steel and vanadium products.

Profit from operations rose from $1,986 million in 2017 to $3,528 million in 2018. Consolidated EBITDA climbed by 43.9 per cent to $3,777 million against the $2,624 million in FY17, reflecting the strong growth in the market and various improvement initiatives. The EBITDA margin stood at 29.4 per cent in 2018. The groupâs net profit increased from $759 million in FY17 to $2,470 million in FY18. The EPS surged to $1.67 this year as against $0.49 in FY2017. Net cash flow from operating activities increased by 34.5 per cent to $2,633 million as compared to $1,957 million in 2017. EVRAZâs capex declined by 12.6 per cent to $527 million as against $603 million in FY17. The Board has declared an interim dividend per share of $0.40.

Share price performance

Daily Chart as at June-26-19, before the market close (Source: Thomson Reuters)

At the time of writing (as on June 26, 2019, at 09:34 AM GMT), shares of Evraz Plc were quoting at GBX 651.2 per share; up by 1.90 per cent against the yesterday's closing price level. The market capitalisation of the company stood at £9.5 billion, with a dividend yield of 14.11 per cent.

In the last 52-weeks, shares of Evraz Plc have registered a high of GBX 710.20 (as on Jun 17, 2019) and a low of GBX 435.50 (as on Jan 04, 2019). At the current trading level, as quoted in the price chart, its shares were trading 8.30 per cent below the 52-week high price level and 49.52 per cent above the 52-week low price level.

The stockâs volume (before the market close, at the time of writing) stood at 303,097. Stock's average traded volume for 5 days was 6,788,204.00; 30 days- 5,823,751.00 and 90 days â 3,554,981.30. The average traded volume for 5 days was up by 16.56 per cent as compared to the 30 days average traded volume. The companyâs stock beta was 1.88, reflecting higher volatility as compared to the benchmark index.

The shares of the company (at the time of writing) were trading above the 30-days and 60-days SMA, which shows a positive trend in the stock price movement and could move up further from the current trading levels.

In the past 1 year, shares of Evraz Plc have delivered a positive price return of 27.09 per cent. Also, on a year-to-date basis, the stock was up by approximately 32.99 per cent and surged by 7.43 per cent in the past three months.

Fresnillo Plc

Fresnillo PLC (FRES) is a Mexico-based precious metal group, which provides mining and exploration services. Â The group has seven operating mines - all of them in Mexico - along with other development and exploration projects and is the world's largest primary silver producer and Mexico's largest gold producer. It develops high potential silver and gold projects into low-cost, world-class mines, with business model spanning the full mining value chain from exploration, construction and development, to mining operations.

Production Updates â First Quarter (ended March-31-2019)

In the Q1 FY2019 period, silver production of 13.1 moz was down by 14.8 per cent, due to lower ore grade and throughput at Fresnillo. Due to a low volume of ore processed, the gold production was down by 8.8 per cent to 211.1 koz vs 1Q18. Pyrites plant (phase II) construction is on track and is expected to commence operations in H2 2020. Fresnillo plc announced and approved the Juanicipio project in partnership with the MAG Silver Corp.

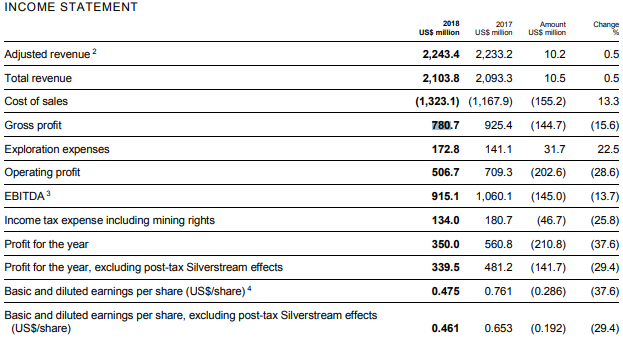

Financial Results - Financial Year 2018 (US$, million)

(Source: Annual Report, Company Website)

Â

In 2018, adjusted revenue rose by 0.5 per cent to $2,243.4 million due to lower metal prices. Total revenue was up by 0.5 per cent to 2,103.8 million in FY2018. A more challenging operating environment reflected in the profitability of the company, with gross profit decreased by 15.6 per cent to $780.7 million, and EBITDA decreased by 13.7 per cent to $915.1 million. A decline of 37.6 per cent in profit for the period FY18 was reported by the company, mainly due to Silverstream revaluation loss recognised in 2018 and lower profit from continuing operations.Â

In FY18, the groupâs profit after tax stood at $350 million against $560.8 million reported last year. Basic and diluted EPS from continuing operations decreased by 37.6 per cent to $0.475. A final dividend of US$ 16.7 cents per share was recommended by the Board.

Share price performance

Daily Chart as at June-26-19, before the market close (Source: Thomson Reuters)

At the time of writing (as on June 26, 2019, at 10:41 AM GMT), shares of Fresnillo PLC were quoting at GBX 865.8 per share; down by 3.04 per cent against the yesterday's closing price level. The market capitalisation of the company stood at £6.58 billion, with a dividend yield of 2.36 per cent.

In the last 52-weeks, shares of Fresnillo PLC have registered a high of GBX 1,164.00 (as on Jun 29, 2018) and a low of GBX 712.55 (as on May 13, 2019). At the current trading level, as quoted in the price chart, its shares were trading 25.61 per cent below the 52-week high price level and 21.50 per cent above the 52-week low price level. The companyâs stock beta was 1.74, reflecting higher volatility as compared to the benchmark index.

Antofagasta Plc

Antofagasta Plc (ANTO) is primarily engaged in activities related to exploration, evaluation and mining of copper in Chile. The companyâs business is divided into two divisions being mining and transportation. The mining segment is further divided into different segments based on the exploration activities and mines of the company.

Production Updates â Q1 FY2019

In Q1 FY2019, Copper production was up by 22.6 per cent to 188,600 tonnes on a y-o-y basis. Gold production was up by 92.6 per cent to 62,200 ounces on a y-o-y basis, on account of higher grades at Centinela. Production of Molybdenum rose by 12.9 per cent. During the first quarter, net cash costs stood at $1.24/lb as compared with $1.54/lb during the corresponding period of the previous financial year.

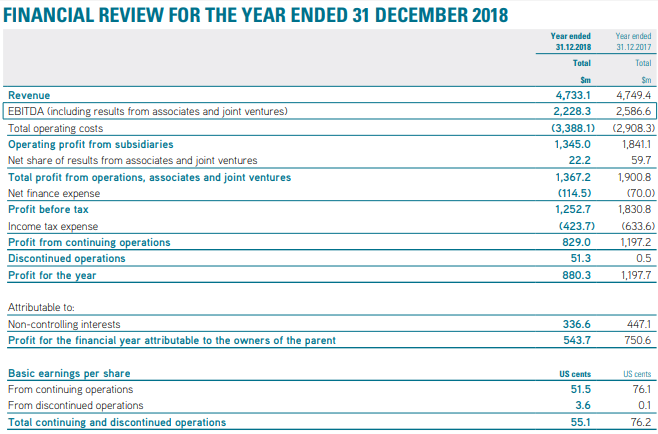

Financial Results - Financial Year 2018 (US$, million)

(Source: Annual Report, Company Website)

Antofagastaâs revenue stood at $4,733.1 million in the financial year 2018 as compared with $4,749.4 million in the financial year 2017. There was a decrease of 0.3 per cent due to a decline of 6.3 per cent of the copper price. EBITDA for FY2018 was $2,228.3 million which was 13.9 per cent lower than the previous year due to grade declines and higher input costs. The total earnings per share stood at 55.1 cents in FY2018 as compared with 76.2 cents in FY2017, down by 27.7 per cent, due to lower EBITDA. Total Net Profit in FY2018 stood at $880.3 million. In line with the company's policy, a final dividend of US 37 cents was announced, bringing the total dividend for the year to $43.8 cents.

Share price performance

Daily Chart as at June-26-19, before the market close (Source: Thomson Reuters)

At the time of writing (as on June 26, 2019, at 11:01 AM GMT), shares of Antofagasta Plc were quoting at GBX 917.4 per share; up by 0.57 per cent against the yesterday's closing price level. The market capitalisation of the company stood at £8.95 billion, with a dividend yield of 3.68 per cent.

In the last 52-weeks, shares of Antofagasta Plc have registered a high of GBX 1,026.00 (as on Apr 15, 2019) and a low of GBX 713.20 (as on Oct 25, 2018). At the current trading level, as quoted in the price chart, its shares were trading 10.58 per cent below the 52-week high price level and 28.63 per cent above the 52-week low price level.

The companyâs stock beta was 1.27, reflecting higher volatility as compared to the benchmark index.

BHP Group PLC

BHP Group PLC (BHP) is a London, United Kingdom-based global resource company with more than 62,000 employees and contractors. The company primarily operates in Australia and America and is engaged in extracting and processing minerals, oil and gas. While the company's global headquarters are in Melbourne, Australia, its products are sold worldwide. The company has two parent companies - BHP Group Limited and BHP Group Plc - as it operates under Dual Listed Group Structure, which are operated as a single economic entity.

Recent News

A Memorandum of Understanding (MoU) has been signed between BHP Group and Mitsubishi Development Pty Ltd on a mutual accord to reduce greenhouse gas emissions. They are investing in new emissions reduction technologies and exploring research ideas.

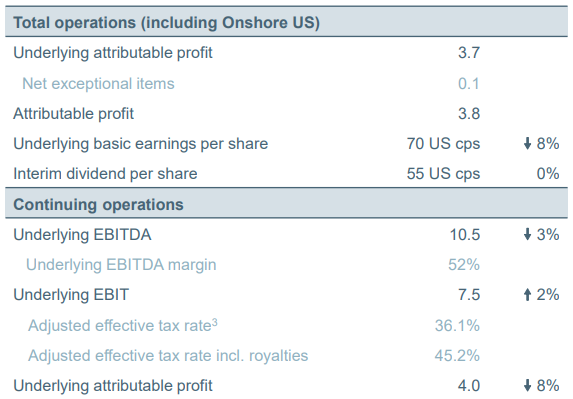

Financial Highlights for H1 FY2019 (US$, million)

(Source: Company Filings)

Â

In the first half of the financial year 2019, the companyâs reported revenue rose by 1.05 per cent to $20,742 million as compared to $20,526 million in the same period last year. The profit (attributable to common shareholders) surged to $3.8 billion as against $2.0 billion in H1 FY 2018. the underlying profit (attributable) plunged by 8 per cent to $3.7 billion against $4.1 billion in the previous period.

Profit from operations rose slightly to $7.3 billion as against $7.2 billion in the previous period. The companyâs underlying EBITDA for H1 FY2019 stood at $10.5 billion as compared to $10.8 billion in H1 FY2018. The EBITDA margin also declined to 52 per cent from 55 per cent a year ago.

Share price performance

Daily Chart as at June-26-19, before the market close (Source: Thomson Reuters)

At the time of writing (as on June 26, 2019, at 11:43 AM GMT), shares of BHP Group PLC were quoting at GBX 1,993.2 per share; up by 0.15 per cent against the yesterday's closing price level. The market capitalisation of the company stood at £108.70 billion, with a dividend yield of 4.24 per cent.

In the last 52-weeks, shares of BHP Group PLC have registered a high of GBX 2,007.50 (as on Jun 25, 2019) and a low of GBX 1,391.99 (as on Oct 25, 2018). At the current trading level, as quoted in the price chart, its shares were trading 0.71 per cent below the 52-week high price level and 43.19 per cent above the 52-week low price level.

The companyâs stock beta was 1.36, reflecting higher volatility as compared to the benchmark index.