Highlights

- RTO’s revenue increased by a notable 44.7% in FY23 compared to FY22

- The company increased its dividend per share by 15% in FY23 compared to FY22

- The company’s medium-term group margin is forecasted to surpass the 19% target by 2026

Rentokil Initial PLC (LSE: RTO) is a FTSE-100 listed provider of pest control and hygiene & wellbeing services. The company operates across Europe, the United Kingdom, North America, Asia, and the Pacific region.

RTO’s revenue increased by a notable 44.7% in FY23 compared to FY22. The surge in revenue was driven by improved performance across various geographies. Similarly, the company’s adjusted profit before tax rose by around 44% and free cash flow surged by around 33.7%.

Additionally, the company increased its dividend per share by 15% in FY23 compared to FY22. It paid a final dividend of 5.93 pence per share attributable for FY23 on 15 May 2024, with an ex-dividend date of 04 April 2024.

Recent business update

As per the company’s Q1FY24 trading update, organic revenue in North America grew by 1.5%, owing to categorical growth in pest control by 2.7%, France workwear by 7.7%, and hygiene & wellbeing by 3.8%.

Company outlook

As per the company, the integration of Terminix is poised to yield significant cost synergies, with an additional USD 50 million expected, elevating the total to USD 325 million by 2026. Under the RIGHT WAY 2 plan, slated for completion by 2026, the company anticipates generating net synergies of approximately USD 40 million, USD 65 million, and USD 38 million in 2024, 2025, and 2026, respectively. Moreover, the medium-term group margin is forecasted to surpass the 19% target by 2026.

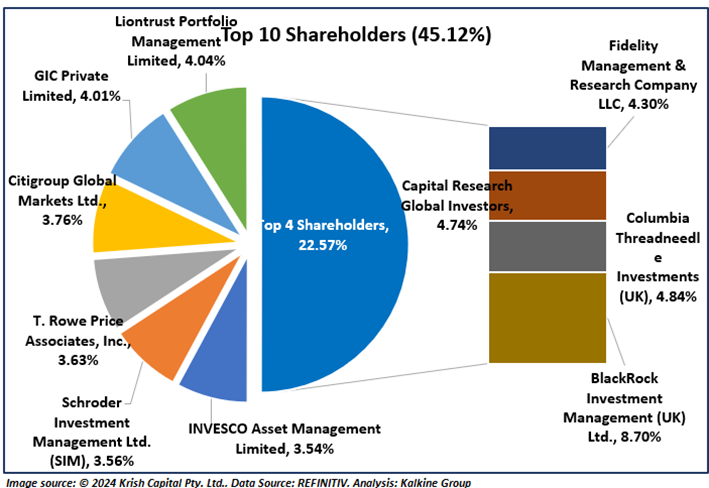

Top 10 Shareholders

The top 10 shareholders of RTO together account for approximately 45.12% of the total shareholdings in the company. BlackRock Investment Management (UK) Ltd. holds the highest number of shares with around 8.70% shareholding. It is followed by Columbia Threadneedle Investments (UK) with around 4.84% shareholding, as illustrated in the chart below:

Stock performance

The share price of RTO has declined by ~3.18% in the last one month and over the last 6 months, it has decreased by ~1.56%. The stock has a 52-week low and 52-week high of GBX 387.80 & GBX 663.80, respectively. At present, it is trading below the average of its 52-week high-low.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 07 June 2024. The reference data in this report has been partly sourced from REFINITIV.