UK stock markets reversed gains in the early afternoon deals on Thursday, 11 February, with the benchmark FTSE 100 erasing morning upsurge after heavyweight banking shares of HSBC Holdings Plc, NatWest Group, Barclays Plc, and Lloyds Banking Group Plc extended losses. The marketwide plunge in oil and natural gas companies, including the Royal Dutch Shell Plc and BP Plc cumulatively added the negative points.

London equities await GDP data

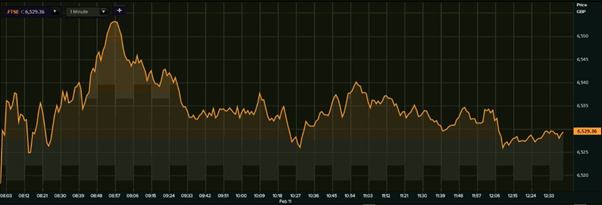

The headline FTSE 100 quickly extended the gains after opening marginally higher in the morning trades but failed to sustain the uptick. A largely similar correction was seen in the other broader market indices with the FTSE 250, FTSE 350 and FTSE All-Share hovering slightly unchanged from the respective previous closes.

FTSE 100 (11 February)

(Source: Refinitiv, Thomson Reuters)

Earlier today, a considerable uptick in the shares of AstraZeneca, Coca Cola HBC AG steered the London equities way up in the positive territory. The stocks of AstraZeneca soared a little more than 3 per cent after the pharmaceutical juggernaut posted better-than-expected results.

AstraZeneca shares pared the gains as the session progressed, at around 1225 GMT, the stock was trading at GBX 7,305, up 0.80 per cent from the previous close of GBX 7,247 apiece.

The gain in London equities remained short lived on Thursday as market participants turned cautious ahead of the GDP growth rate due on 12 February along with a bunch of other macroeconomic indicators including the balance of trade, industrial production, and manufacturing production.

With a set of uncertainties prevailing in the domestic market, FTSE 100 failed to bounce back even after the futures linked to Dow Industrials surged, indicating a positive start on Wall Street. Shares of heavyweight companies including Royal Dutch, NatWest, Lloyds Banking, Anglo American, Barclays, Tesco and BP slumped between 1 and 3 per cent.

Mixed bag of trade in Europe

At around 1216 GMT, FTSE 100 was trading at 6,528.09, up 3.73 points, or 0.05 per cent from the last close of 6,524.36. Parallelly, FTSE 250, FTSE 350 and FTSE-All share traded with a gain of not more than 0.05 per cent.

A mixed-bag trading activity was seen in the regional European markets as France’s CAC 40 traded unchanged, Germany’s DAX gained 0.50 per cent, Switzerland’s SMI surged 0.29 per cent, Spain’s IBEX 35 dropped 0.24 per cent, while Italy’s FTSE MIB advanced 0.14 per cent.

GBP slips into red

Meanwhile, the Great Britain pound (GBP) fell further into negative territory against the United States dollar (USD) even after the greenback slipped to a two-week low against a basket of currencies. At around 1310 GMT, the GBP vs USD pair was trading at 1.3826, down 0.02 per cent from the previous close of 1.3828 at the interbank foreign exchange market on Thursday.

During the day so far, the currency pair has oscillated in a range of 1.3814 and 1.3860, respectively. The Bank of England fixed a reference exchange rate of 1.3845 USD and 1.1413 EUR against a unit of pound sterling on 10 February.

.jpg)