Highlights

The FTSE 100 have recently seen downward pressure amid macroeconomic uncertainty.

Smaller companies listed on the AIM and LSE with market caps under a specific threshold are drawing attention for their operational updates.

Firms in diverse sectors including healthcare, consumer goods, and engineering have delivered notable financial performance in recent disclosures.

The broader UK equity market, represented by the FTSE 100, has recently experienced volatility influenced by global trade activity and sentiment from overseas markets. Amid this backdrop, several lower-capitalised firms have continued reporting consistent revenue generation and sectoral relevance. These companies fall outside the FTSE 100 yet maintain a presence across healthcare, manufacturing, and financial services.

NIOX Group – Specialised Medical Diagnostics

NIOX Group (LSE:NIOX) operates in the healthcare space, developing and commercialising non-invasive technologies for monitoring airway inflammation in patients, primarily those with asthma. The firm’s flagship product segment, NIOX®, supports clinicians in diagnosis and treatment adherence across global markets. Recent disclosures reflected stable revenue figures from this primary operating division. The company maintains its listing on the AIM exchange with a market capitalisation beneath large-cap thresholds.

Ultimate Products – Consumer Goods Supply Chain

Operating under the consumer discretionary sector, Ultimate Products (LSE:ULTP) manages and licenses branded household products across categories such as kitchen appliances, laundry, and homeware. The company distributes products through a network of retail partners and online platforms. With a portfolio featuring established brand names, Ultimate Products continues to expand its commercial agreements in international markets. It remains listed on the LSE Main Market and operates with a lean capital structure.

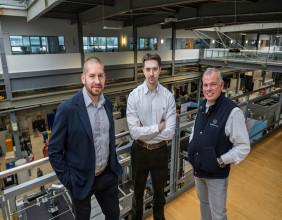

Van Elle Holdings – Ground Engineering Services

Van Elle Holdings (LSE:VANL) delivers geotechnical engineering and foundation services across infrastructure, construction, and housing developments in the UK. The company’s operations include piling, rail infrastructure works, and ground improvement services. Headquartered in Nottinghamshire, it has maintained a diversified client base ranging from utility providers to housebuilders. The AIM-listed company has demonstrated order book progression in recent months, reporting activity across both public and private sector projects.

Begbies Traynor Group – Business Recovery and Advisory

Begbies Traynor Group (LSE:BEG) operates within the professional services sector, offering business restructuring, insolvency advice, and property services. The company has built a nationwide footprint, with advisory operations supporting small and mid-sized enterprises. As macroeconomic pressures influence business liquidity, the firm’s restructuring arm has remained active across sectors. It remains listed on the AIM and operates with a mid-level capitalisation.

Warpaint London – Colour Cosmetics Development

Warpaint London (LSE:W7L) is involved in the design and supply of branded cosmetics and skincare products, marketed under brand names such as W7 and Technic. The company operates through a network of distributors and direct-to-consumer channels across the UK and international territories. Following steady revenue updates, the business has grown its presence in online platforms and continues product development across various segments. It is listed on the AIM exchange with a capital base positioned below the FTSE 100 threshold.

LSL Property Services – Real Estate and Financial Services

LSL Property Services (LSE:LSL) functions in the property sector through estate agency operations, surveying services, and financial advisory. The company operates under multiple regional and national estate agency brands. Despite broader property market fluctuations, its financial services segment has demonstrated revenue stability. The firm remains listed on the London Stock Exchange and reports updates across its diversified property and mortgage-related divisions.

Cairn Homes – Residential Construction in Ireland

Cairn Homes (LSE:CRN) is engaged in residential construction and land development, primarily operating across Ireland. The company focuses on delivering new housing projects with an emphasis on urban areas. Recent updates from the firm have shown a continuation of unit completions across various locations. While based in Ireland, its primary listing is on the LSE, and it maintains a market capitalisation outside of the FTSE 100.