US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 15.55 points or 0.36 per cent higher at 4,323.09, Dow Jones Industrial Average Index surged by 215.54 points or 0.64 per cent higher at 34,059.46, and the technology benchmark index Nasdaq Composite traded higher at 14,454.60, up by 6.00 points or 0.04 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note despite encouraging updates from U.S. pharma giant Merck. Among the gaining stocks, Merck (MRK) shares climbed by around 8.21% after the announcement that its experimental Covid-19 pill came out to be effective in a late-stage study. Zoom Video Communications (ZM) shares rose by around 3.01% after the Company terminated a USD 15 billion deal with Five9 by mutual consent. Nio (NIO) shares went up by around 0.18% after the Company achieved year-on-year growth of around 126% in the number of vehicles delivered during September 2021. Among the declining stocks, Lordstown Motors Corp (RIDE) shares plunged by around 12.41% after the Company decided to sell the Ohio plant to Taiwan’s Foxconn in a lucrative deal.

UK Market News: The London markets traded in a red zone due to the weak performance of financial and mining stocks. According to the latest figures from the IHS Markit/CIPS, the UK manufacturing PMI had dropped for the fourth month in a row as it came out to be ~57.1 during September 2021 against ~60.1 during August 2021.

AO World shares plunged by about 23.00% after the Company emphasized on industrywide issues relating to ongoing supply chain disruption in the trading update released today. However, it had expected a marginal increase in the total revenue during H1 FY22.

Euromoney Institutional Investor shares surged by around 7.09% after the Company anticipated full-year FY21 adjusted profit before tax to remain more than the analysts' expectations.

JD Wetherspoon had reported the worst full-year loss during FY21 because of the closure of pubs during the lockdowns. However, the shares grew by around 3.21%.

FTSE 100 listed Pearson shares rose by around 1.28% after a report from Citi highlighted an interesting valuation opportunity due to the heavy selloff.

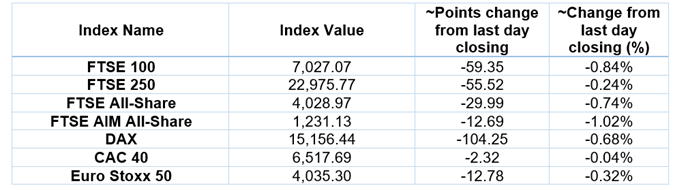

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 01 October 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Sectors traded in green*: Utilities (0.81%), Real Estate (0.27%), Consumer Cyclicals (0.06%).

Top 3 Sectors traded in red*: Health Care (-2.02%), Basic Materials (-1.73%), Consumer Non-Cyclicals (-1.67%).

Top 3 gainers on FTSE All-Share index*: Euromoney Institutional Investor PLC (7.09%), SSP Group PLC (6.50%), Watches of Switzerland Group PLC (6.34%).

Top 3 losers on FTSE All-Share index*: AO World PLC (-24.01%), Currys PLC (-8.61%), Hill & Smith Holdings PLC (-5.29%).

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $79.23/barrel and $75.83/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,759.75 per ounce, up by 0.16% against the prior day closing.

Currency Rates*: GBP to USD: 1.3560; EUR to USD: 1.1599.

Bond Yields*: US 10-Year Treasury yield: 1.481%; UK 10-Year Government Bond yield: 1.0080%.

*At the time of writing