Wall Street futures were trending higher ahead of the opening bell on Thursday, with market participants bracing for several key data releases later in the day.

As of 12:45 BST, Dow Jones futures had risen by 0.56%, while S&P 500 and Nasdaq-100 futures showed gains of 0.18% and 0.19%, respectively.

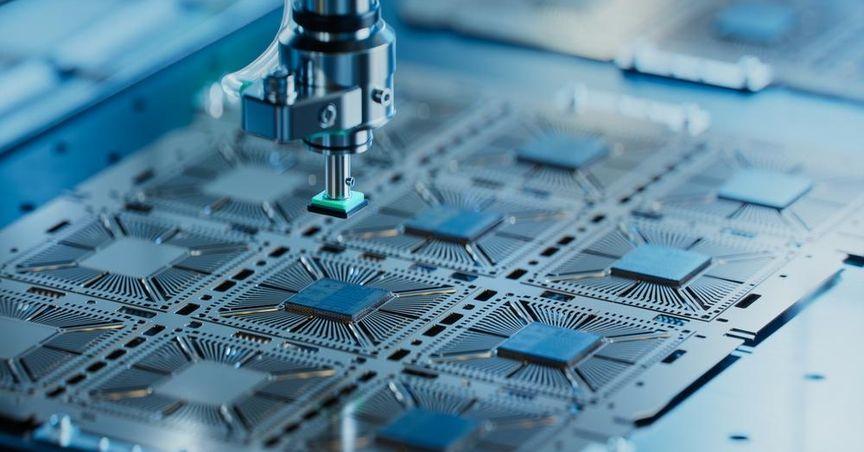

The Dow closed 159.08 points lower on Wednesday as traders anticipated critical quarterly earnings from Nvidia (NASDAQ:NVDA), the prominent AI-focused chipmaker.

Following the market close, Nvidia's earnings were released, with the company's shares dropping 5% in extended trading despite surpassing expectations. Adjusted earnings per share reached $0.68, beating the consensus estimate of $0.64, while revenue of $30.04 billion exceeded the projected $28.98 billion.

Joshua Mahony of Scope Markets noted, "The after-hours reaction to Nvidia's earnings has puzzled many, with the company losing over 6% despite exceeding estimates across the board. Markets often focus on potential negatives when a company has experienced such remarkable gains, and this appears to be a case of crafting a negative narrative even when one doesn't clearly exist. The fact that the Q3 outlook is only slightly above estimates raises some questions about whether the pace of growth will slow from here."

He added, "However, if past performance is any indication, Nvidia may well surpass those estimates, just as it did with both revenue and earnings in the most recent quarter. For now, this dip may present a potential opportunity, while the broader markets can also find some relief in the fact that the second-quarter earnings season has concluded and has generally been successful."

Elsewhere in the corporate sector, Best Buy shares rallied in pre-market trading after the retailer raised its FY25 profit guidance, supported by solid quarterly earnings and a revenue beat. In contrast, Dollar General shares declined after the discount retailer's latest quarterly earnings missed Wall Street expectations.

On the macroeconomic front, weekly jobless claims data will be released at 13:30 BST, along with preliminary readings of Q2 GDP figures, July wholesale inventories, and the previous month's goods trade balance. July pending home sales data will follow at 15:00 BST.