US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 34.99 points or 0.78 per cent higher at 4,504.90, Dow Jones Industrial Average Index surged by 214.51 points or 0.61 per cent higher at 35,427.63, and the technology benchmark index Nasdaq Composite traded higher at 15,113.50, up by 167.70 points or 1.12 per cent against the previous day close (at the time of writing – 12:10 PM ET).

US Market News: The major indices of Wall Street traded in a green zone after Federal Reserve Chair Jerome Powell affirmed that there wouldn’t be any rush for the interest rate hike. Among the gaining stocks, Gap (GPS) shares grew by around 2.28% after the apparel retailer’s quarterly top-line revenue and bottom-line profitability came out to be more than the consensus estimates. Among the declining stocks, Hibbett Sports (HIBB) shares fell by about 10.99%, even after the Company raised the full-year outlook. Peloton (PTON) shares dropped by about 9.01% after the fitness equipment maker had reported a wider-than-expected loss for the latest quarter. Big Lots (BIG) shares went down by around 2.89% after the Company missed top-line revenue and bottom-line profitability forecasts for the latest quarter.

UK Market News: The London markets traded in a green zone, with FTSE 100 witnessing an increase driven by the heavyweight mining and energy stocks, which surged due to solid growth in commodity price.

Subprime Lender Amigo Holdings shares went up by about 3.80% after the Company had reported decent growth in first-quarter profit. Moreover, the Company highlighted some material uncertainty to continue as a going concern.

FTSE 100 listed Just Eat Takeaway.com shares plunged by around 6.40% after the New York City Council approved legislation regarding putting a cap on the commission that delivery app can charge restaurants.

Aerospace & Defence Engineer Babcock International Group got upgraded by Barclays from “equalweight” to “overweight”. Moreover, the shares went up by around 0.21%.

Primary Health Properties shares rose by around 0.58% after the Company had acquired Townside Primary Care Centre and adjacent office building in Bury for the total consideration of approximately £40 million.

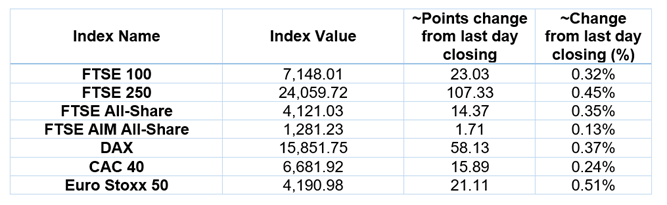

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 27 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); Barclays PLC (BARC).

Top 3 Sectors traded in green*: Basic Materials (+1.41%), Energy (1.40%), Real Estate (0.75%).

Top 3 Sectors traded in red*: Technology (-0.94%), Utilities (-0.40%) and Consumer Cyclicals (-0.36%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.59/barrel and $68.69/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,819.45 per ounce, up by 1.35% against the prior day closing.

Currency Rates*: GBP to USD: 1.3767; EUR to USD: 1.1793.

Bond Yields*: US 10-Year Treasury yield: 1.319%; UK 10-Year Government Bond yield: 0.5765%.

*At the time of writing