UK Market: The UK stock markets have extended their gains on Wednesday. The blue-chip FTSE100 index is up by 0.75%, while the mid-cap focused FTSE 250 index was higher by 0.88%. Copper mining group Antofagasta Plc (-4.81%) was among the top losers after the reports that the Chilean government could nationalise its copper industry. The country’s environmental commission has approved the early-stage resolution regarding the same.

OCADO Group Plc (LON: OCDO): The grocery retail firm was up by over 7%, with a day’s high of GBX 1,546. The stock price rebounded after yesterday’s fall of around 5%. The company last month announced the launch of its proprietary Ocado Smart Platform to cater to consumer demand.

Chamberlin Plc (LON:CMH): The specialist castings and engineering group was down by over 27%, with a day’s low of GBX 5.13 after the company announced that it had raised £1.8 million through placing at a price of 5p per share.

Molten Ventures Plc (LON:GROW): The venture capital firm’s share was up by over 5%, with a day’s high of GBX 828 after the company reported solid revenue growth from portfolio companies through 2021. It invested £259 million during the period, including 12 primary deals and 15 follow-ons deals.

US Markets: The US market is likely to open in the positive territory indicated by gains in the future indices. S&P 500 futures were up by 34 points or 0.77% at 4,569, while the Dow Jones 30 futures were up by 0.13% or 44 points at 35,321. The technology-heavy index Nasdaq Composite future was up by 1.28% at 15,178 following positive results from Alphabet Inc. (At the time of writing – 8:50 AM ET).

US Market News:

Shares of the medical device maker, Boston Scientific (BSX), were down by over 4% in premarket trading after the company forecasted a weaker business outlook. However, the latest quarterly earnings reported by the company were above the market forecast.

Shares of the restaurant chain operator Brinker International (EAT), were up by over 8% after the company reported upbeat business performance in its latest quarter.

Shares of Google’s parent company, Alphabet (GOOGL), rose by over 10% after the company reported a record fourth-quarter profit. Also, the company announced a 20-for-1 stock split.

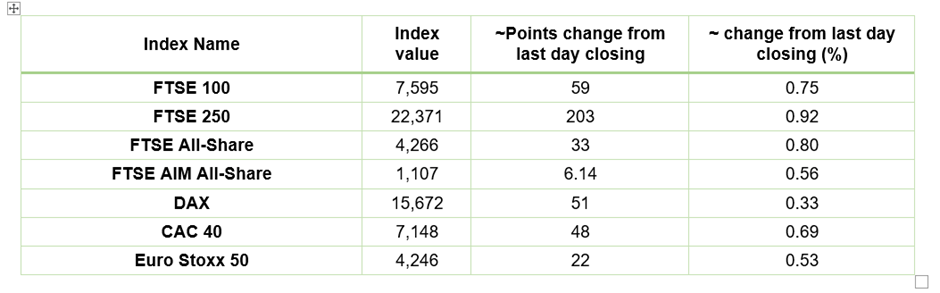

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), International Consolidated Airlines Group (IAG).

Top 3 Sectors traded in green*: Technology (2.04%), Financials (1.35%), Consumer Cyclicals (1.26%).

Top 2 Sectors traded in red*: Healthcare (-0.16%), Utilities (-0.04%).

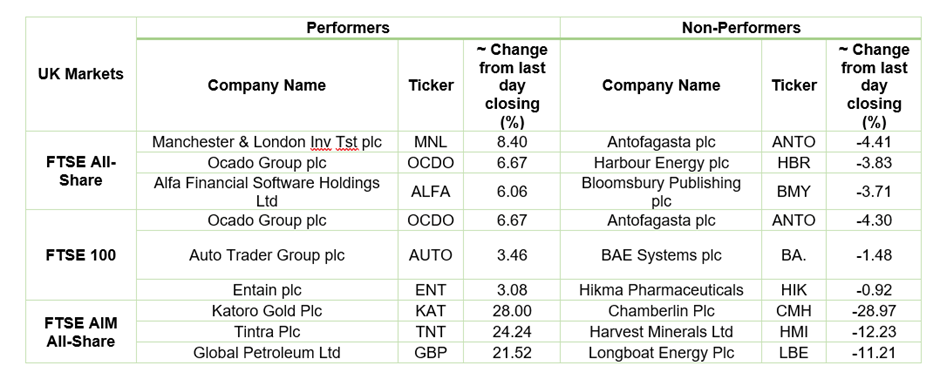

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $90.12/barrel and $89.34/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,804 per ounce, up by 0.14% against the prior day closing.

Currency Rates*: GBP to USD: 1.3574; EUR to USD: 1.1320.

Bond Yields*: US 10-Year Treasury yield: 1.791%; UK 10-Year Government Bond yield: 1.2975%.

*At the time of writing