UK Market: The UK stock market traded lower on Thursday, extending its losses for the second straight session. The blue-chip FTSE100 index was down by 0.76%. The uncertainty surrounding the Russia-Ukraine conflict impacted the stock market. As per the US intelligence officials, Russia has not withdrawn its troops from the Ukraine borders. Mining company Evraz Plc (-6.88%) was amongst the top losers amid rising tension between the two countries.

Hurricane Energy Plc (LON: HUR): The hydrocarbon resources company was up by over 27%, with a day’s high of GBX 7.60 after the company announced an operational update about its Lancaster field operations. The site is producing 9,500 bopd oil from the P6 well alone as of 14 February 2022.

Standard Chartered Plc (LON: STAN): The banking service provider was down by around 2.5%, with a day’s low of GBX 520.80 after the company announced its annual results. The stock price was down after its annual profits fell short of expectations.

Ferrexpo Plc (LON: FXPO): The iron ore mining company’s share was down by over 6%, with a day’s low GBX 274.60 amid uncertainty around the Russia-Ukraine conflict. The company has a significant business presence in the Ukraine region.

US Markets: The US market is likely to open in red as indicated by the futures indices. S&P 500 future was down by 30 points or 0.67% at 4,439, while the Dow Jones 30 future was down by 0.54% or 189 points at 34,661. The technology-heavy index Nasdaq Composite future was down by 0.79% at 14,484 (At the time of writing – 8:50 AM ET).

US Market News:

The food delivery service provider, DoorDash (DASH), was up by over 24% in premarket trading after the company reported an upbeat business outlook in the current quarter. Although the company reported the loss, its revenue was above the market expectations despite the opening of dine-in services by many restaurants after an ease in restrictions.

The software platform provider, Palantir Technologies (PLTR), was down by over 8% after the announcement of its quarterly earnings. The company’s revenue was above the forecast. However, its earnings were lower than the expectations.

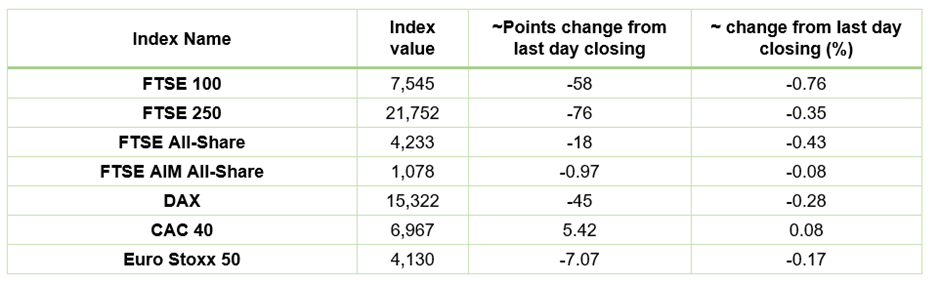

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 17 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP Plc (BP.)

Top 2 Sectors traded in green*: Utilities (0.14%), Consumer Non-Cyclicals (0.05%),

Top 3 Sectors traded in red*: Energy (-1.83%), Financials (-1.44%), Basic Materials (-1.35),

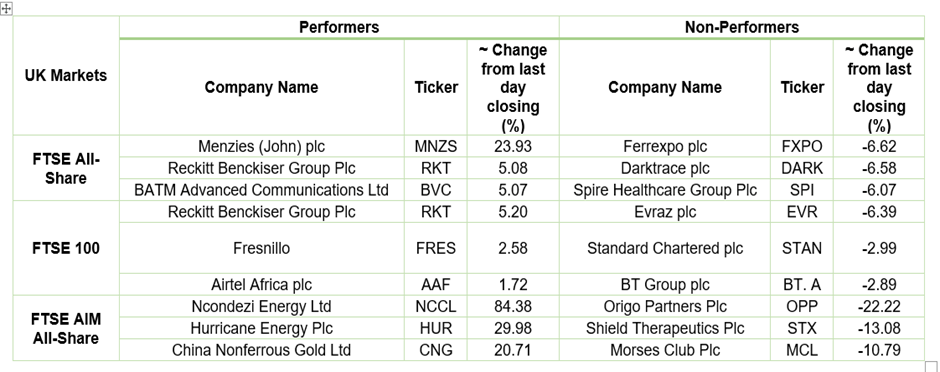

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $94.06/barrel and $93.03/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,894 per ounce, up by 1.22% against the prior day closing.

Currency Rates*: GBP to USD: 1.3619; EUR to USD: 1.1359.

Bond Yields*: US 10-Year Treasury yield: 2.001%; UK 10-Year Government Bond yield: 1.4965%.

*At the time of writing