UK Market: The UK stock markets have extended their bearish trend for the second day in a row on Friday, reacting to the selloff in the global stock market after the higher-than-expected US inflation data that was announced yesterday. The rising inflation in the US will most likely lead to an interest rate hike by the Federal Reserve. The blue-chip FTSE100 index is down by 0.64%.

Micro Focus International Plc (LON: MCRO): The technology company was down by over 3%, with a day’s low of GBX 445.80. The stock price witnessed profit booking after two consecutive days of positive close following an upbeat business performance for the year ended 31 October 2021. The share price is up by 1.55% since Monday.

Tavistock Investment Plc (LON: TAVI): The AIM-listed financial service group was up by 32%, with a day’s high of GBX 4.90 after the company terminated its proposed acquisition of Morgan Financial Group Holdings Limited.

Tate & Lyle Plc (LON:TATE): The FTSE250 listed food product company was up by over 7%, with a day’s high of GBX 762.20 after the company announced its business update for three months to 31 December 2021. The company reported double-digit revenue growth of 18% during the period.

US Markets: The US market is likely to make a flat-to-soft start as indicated by the movement of the futures indices. S&P 500 future was down by 5 points or 0.15% at 4,495, while the Dow Jones 30 futures was down by 0.04% or 15 points at 35,148. The technology-heavy index Nasdaq Composite future was up by 0.10% at 14,717 (At the time of writing – 8:50 AM ET).

US Market News:

The travel booking portal, Expedia (EXPE), was up by 4.6% in premarket trading after the company announced its business update for the latest quarter. Its adjusted earnings were at USD 1.06 per share above the market forecast.

The cloud computing company, GoDaddy (GDDY), rose by 5.8% in premarket trading after the company reported higher quarterly revenue. Also, the company announced a USD 3 billion share buyback program for its shareholders.

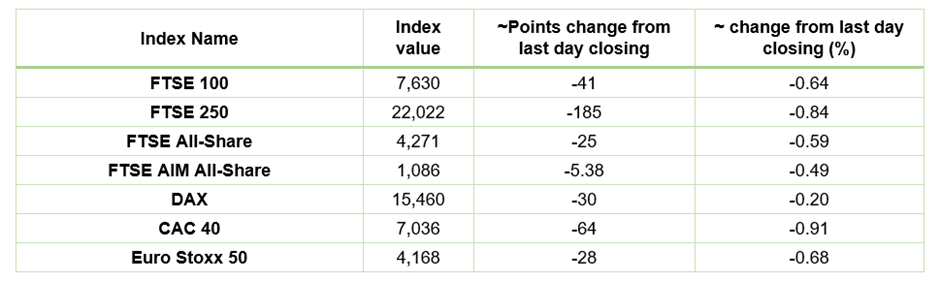

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 11 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP Plc (BP.)

Top 3 Sectors traded in green*: Consumer Non-Cyclicals (0.60%), Utilities (0.35%), Energy (0.19%)

Top 3 Sectors traded in red*: Real Estate (-2.77), Healthcare (-1.53%), Financials (-1.24%).

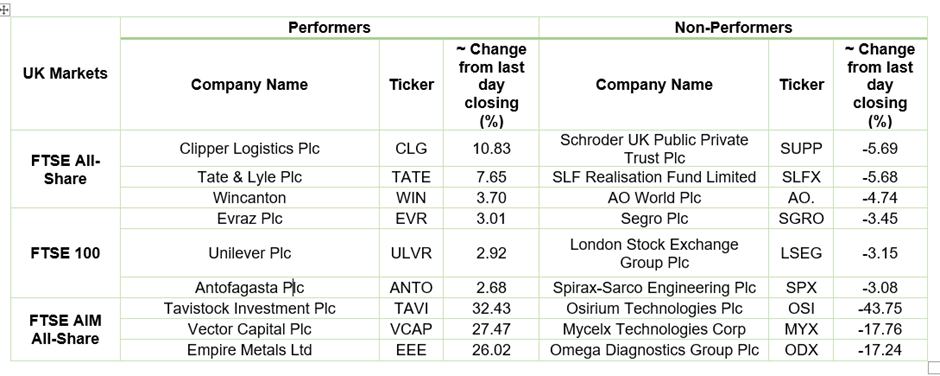

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $92.29/barrel and $90.28/barrel, respectively.

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $92.29/barrel and $90.28/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,826 per ounce, down by 0.58% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.3572; EUR to USD: 1.1395.

Bond Yields*: US 10-Year Treasury yield: 2.008%; UK 10-Year Government Bond yield: 1.5150%.

*At the time of writing

.jpg)