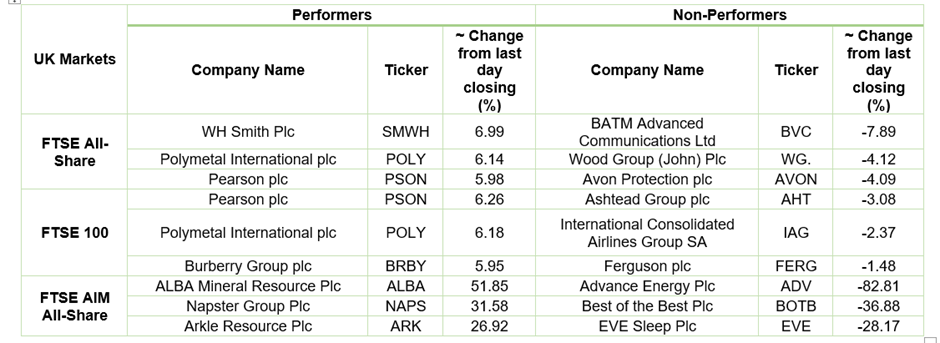

UK Market: The UK stock market overlooked the news of inflation hitting a 30-year high and moved higher. As per the Office for National Statistics (ONS) data, Consumer Prices Index (CPI) inflation surged to 5.4% in the month of December, which is the highest level since March 1992. The blue-chip FTSE 100 index is up by 0.51%, lifted by stocks like Pearson Plc (6.77%), Burberry Group Plc (6.01%) after announcing their business update. The mid-cap-focused FTSE 250 index was up by 0.28%.

Burberry Group Plc (LON: BRBY): Shares of the luxury fashion retailer were up by over 6.0%, with a day’s high of GBX 1,875 after the company announced its business update for the third quarter ended 25 December 2021. Solid underlying revenue performance during the period resulted in a sharp rise in share price.

Advance Energy Plc (LON:ADV): Shares of the AIM-listed oil & gas company were down by over 84%, with a day’s low of GBX 0.68 after the company gave the latest drilling update about its Buffalo-10 Well. The project site’s seismic velocities or imaging resolution issues are not yet resolved.

WH Smith Plc (LON: SMWH): Shares of the high street retailer were up by over 6.5%, with a day’s high of GBX 1,658 after the company announced a positive business revenue update for the 20 weeks to 15 January 2022. The total group revenue was 85% of the 2019 revenue during the period.

US Markets: The US market is likely to follow the trend with a positive start, as indicated by the futures indices. S&P 500 future was up by 19 points or 0.42% at 4,590, while the Dow Jones 30 futures was up by 0.31% or 107 points at 35,373. The technology-heavy index Nasdaq Composite future was up by 0.63% at 15,300 (At the time of writing – 8:50 AM ET).

US Market News:

Shares of the consumer goods company Procter & Gamble (PG) was up by 1% in premarket trading after announcing a positive business update for the second quarter. The company reported a rise in organic growth, with a profit of USD 1.66 per share.

Shares of the gaming console maker Sony Inc. (SONY) fell by over 3.9% in premarket trading after the announcement of the Microsoft-Activision Blizzard deal. Investor fears that the deal will create additional competitive pressure for the company.

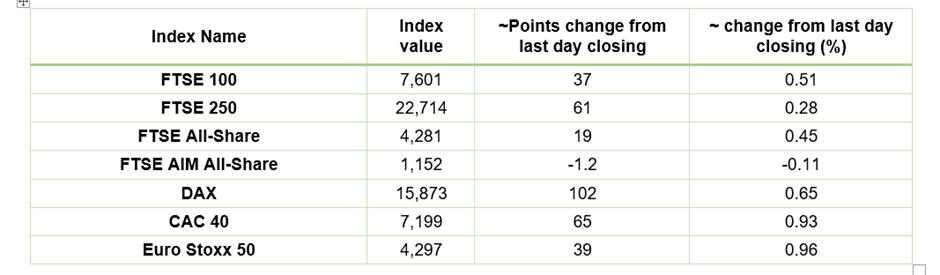

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 19 January 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), Barclays Plc (BARC)

Top 3 Sectors traded in green*: Basic Materials (2.36), Real Estates (1.07), Consumer Cyclicals (0.90%),

Top 3 Sectors traded in red*: Utilities (-0.64%), Healthcare (-0.24%), Industrials (-0.09%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $88.13/barrel and $85.47/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,824 per ounce, up by 0.65% against the prior day closing.

Currency Rates*: GBP to USD: 1.3627; EUR to USD: 1.1343.

Bond Yields*: US 10-Year Treasury yield: 1.868%; UK 10-Year Government Bond yield: 1.2620%.

*At the time of writing

.jpg)