UK Markets: The UK market was down on Wednesday following the latest numbers on UK's Gross Domestic Product (GDP). At around 1:30 pm GMT+1, the FTSE 100 was down 0.30%, while the mid-cap-focused FTSE 250 was more than 0.60% down. This happened as the latest data showed that the country's economy contracted by 0.4% in August, showing a fall for the first time in two months. Besides, July's numbers were also revised from 0.2% to 0.1%.

JD Sports Fashion PLC (LON: JD.): Shares of the sports apparel retailer slipped over 8.5% after it announced that its CFO Neil Greenhalgh will step down from the position.

Marks & Spencer (LON:MKS): Shares of the multinational retailer fell nearly 5% after it revealed its plans to shut down close to 25% of its stores selling apparel and home improvement products and open over 100 Simply Food outlets.

Barratt Developments PLC (LON:BDEV): Shares of the residential property developer tumbled more than 7% after it posted its latest numbers. The company said that in the period beginning 1 July 2022 to 9 October 2022, private reservations remained below the level seen in FY22 due to the current economic scenario.

US Markets: The US market is likely to get a mixed start, as indicated by the futures indices. S&P 500 future was down by 23.55 points or 0.65% at 3,588.84, while the Dow Jones 30 future was up by 0.12% or 36.31 points at 29,296.79. The technology-heavy index Nasdaq Composite future was down by 1.10% or 115.91 points, at 10,426.19. (At the time of writing – 9:04 am ET).

US Market News

Shares of the beverage maker PepsiCo (PEP) gained 2.4% in the premarket trading session after the company reported an estimate-beating adjusted quarterly profit of $1.97 per share. It also raised its guidance for the year.

Shares of chipmaker Intel (INTC) surged 1% in the premarket trading session following a report claiming that the company is planning to cut thousands of jobs amid a slump in the personal computer market.

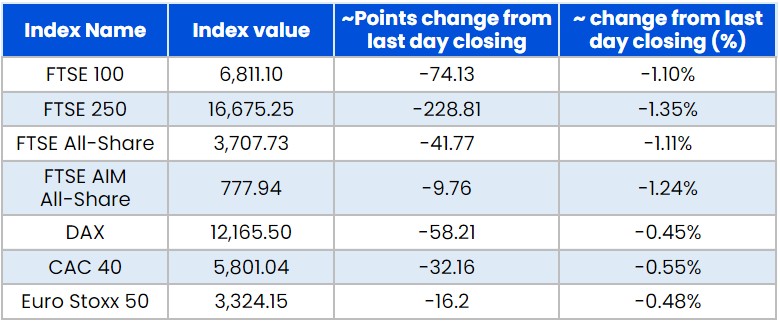

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 12 October)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Barclays Plc (BARC), Vodafone Group Plc (VOD)

Top 3 sectors traded in green*: Healthcare (0.24%)

Top 3 sectors traded in red*: Financials (-2.69%), Technology (-2.36%), Consumer Cyclicals (-2.25%)

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $94.77/barrel and $89.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,672.80 per ounce, down 0.78% against the prior day's closing.

Currency Rates*: GBP to USD: 1.1052; EUR to USD: 0.969.

Bond Yields*: US 10-Year Treasury yield: 3.929%; UK 10-Year Government Bond yield: 4.583%.

*At the time of writing