US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 99.26 points or 2.83 per cent higher at 3,608.70, Dow Jones Industrial Average Index expanded by 1,092.42 points or 3.86 per cent higher at 29,415.82, and the technology benchmark index Nasdaq Composite traded higher at 12,036.16, up by 140.93 points or 1.18 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: All the major US indices traded in green on the election victory of Joe Biden and positive vaccine news unveiled by Pfizer. By the end of November, the Company and Biontech Se (partner) will seek for regulatory approval, and as per the latest statement by the Company, around 1.3 billion doses could be manufactured by next year-end. It has been a blistering rally observed today with Dow Jones and S&P 500 traded at all-time highs. Among the travel & leisure stocks, the Carnival corporation surged significantly by around 37%, AMC Entertainment expanded by 66%, Six Flags shares zoomed by over 19%. Airlines shares were also in the limelight as Spirit Airlines, and JetBlue Airways surged massively by over 22% each as vaccine development could present a ray of hope of an increase in travel in the near term.

However, some beaten-down stocks which were trending during the day were Peloton and Zoom Video Communications Inc, down by over 15%.

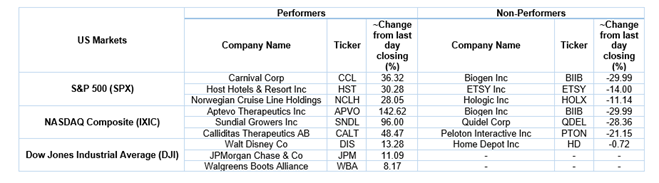

US Stocks Performance*

European News: All the major European indices traded in green as positive vaccine developments were reported by Pfizer and BioNTech. FTSE 100 traded near three months high in the Monday trading session. Among the gainers, Taylor Wimpey accelerated by around 18% after the Company said to deliver results at the upper end of expectations. Travel and Oil shares zoomed and were trending during the day. Countrywide Plc surged by around 40% led by early-stage buyout talks from Connells. Among the other shares which were in the bright spot – Rolls Royce surged by around 43%; Airline stock – International Consolidated Airlines surged by 25% due to further hopes of increase in travel. Travel and Leisure sector, which was among the worst-hit sectors expanded significantly with SSP, Easyjet, Carnival, Cineworld inched higher by more than 35%.

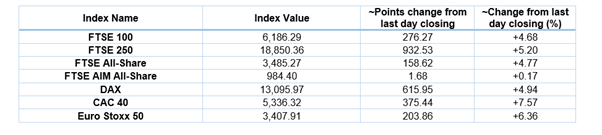

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 9 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Energy (+13.27%), Financials (+9.04%) and Real Estate (+6.83%).

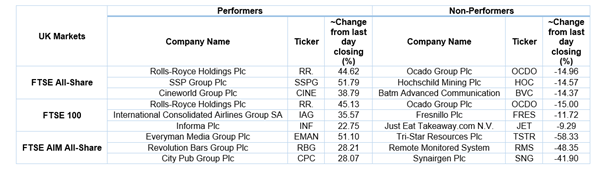

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $43.12/barrel and $40.98/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,877.30 per ounce, down by 3.81% against the prior day closing.

Currency Rates*: GBP to USD: 1.3189; EUR to GBP: 0.9030.

Bond Yields*: US 10-Year Treasury yield: 0.932%; UK 10-Year Government Bond yield: 0.367%.

*At the time of writing

.jpg)