US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 55.06 points or 1.47 per cent higher at 3,803.20, Dow Jones Industrial Average Index expanded by 265.07 points or 0.86 per cent higher at 31,094.47, and the technology benchmark index Nasdaq Composite traded higher at 13,014.58, up by 273.78 points or 2.15 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in green as US Congress finally certifies Joe Biden’s election win. The Initial Jobless Claims dropped to 787,000 for the week ended on 02 January 2021, while it was 790,000 for the prior week. Among the gaining stocks, CureVac NV grew by about 15.72% after the company announced its deal with Bayer to accelerate the development of Covid-19 vaccine. Shares of Constellation Brands went up by around 3.12% after the company beats consensus estimates regarding its latest quarterly earnings. Walgreens gained about 2.72% after the company made quarterly earnings more than the estimates. Among the declining stocks, Shares of Bed Bath & Beyond went down by 13.08% after the company reported revenues short of its forecasts. Alibaba shares fell by about 0.14% after the news that the US is considering it for blacklisting.

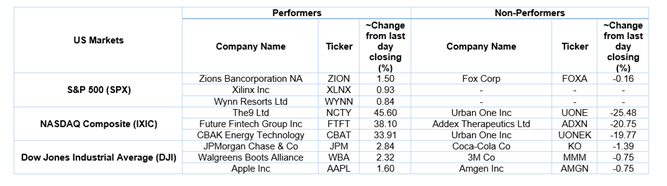

US Stocks Performance*

European News: The London and European markets traded in green as the violence on Capitol Hill was partially offset by the hopes of further US stimulus announcement. The Construction Purchasing Manager Index (PMI) slipped to 54.6 during December 2020, while it was 54.7 during November 2020. Among the gaining stocks, Shares of Mpac Group went up by 10.12% after the company forecasted profit more than its expectations. Shares of Sainsbury soared by 3.61% after the company increased its profit before tax forecast for the year ending March 2021. Shares of Entain grew by 0.79% after it had decided to buy sports betting firm Enlabs AB for £250 million. Among the decliners, Shares of IP Group fell by 8.11% after Invesco sold 61.9 million shares in the company. Shares of Mitchells & Butlers went down by 6.53% after the company announced its plans to raise capital from shareholders. B&M European Value Retail S.A. dropped by 0.11% although it had declared a special dividend of 20 pence per share.

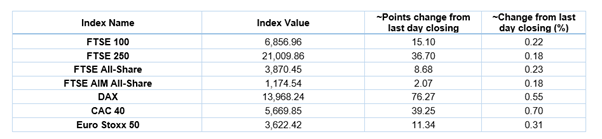

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 7 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 2 Sectors traded in green*: Basic Materials (+1.29%) and Technology (+0.46%).

Top 3 Sectors traded in red*: Real Estate (-1.29%), Industrials (-1.09%) and Healthcare (-1.07%).

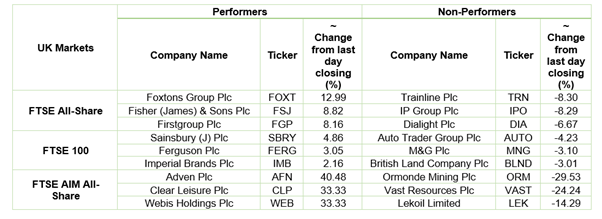

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $54.42/barrel and $50.84/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,914.30 per ounce, up by 0.30% against the prior day closing.

Currency Rates*: GBP to USD: 1.3557; EUR to GBP: 0.9051.

Bond Yields*: US 10-Year Treasury yield: 1.080%; UK 10-Year Government Bond yield: 0.282%.

*At the time of writing