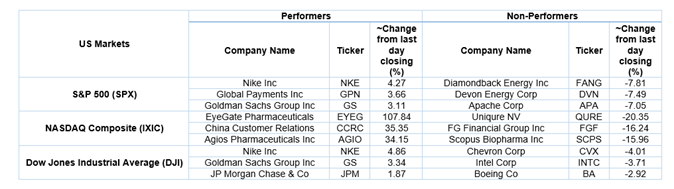

US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 63.19 points or 1.70 per cent lower at 3,646.22, Dow Jones Industrial Average Index dipped by 333.91 points or 1.11 per cent lower at 29,845.14, and the technology benchmark index Nasdaq Composite traded lower at 12,552.85, down by 202.79 points or 1.59 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The major indices of Wall Street traded in the negative territory due to the dented investor confidence as the covid-19 cases continue to rise. The Chicago Fed’s national activity index had declined to 0.27 in November 2020 from 1.01 recorded in the previous month. Among the gaining stocks, Nike soared by approximately 6.1% after the company posted impressive second-quarter results. JP Morgan Chase & Co stock gained around 3.9% after the company announced its intention to initiate a buyback of US$30 billion in its first quarter of 2021. Among the declining stocks, Diamondback shares dropped by about 6.7% after the company agreed to buy QEP Resources in an all-stock deal worth US$2.2 billion. Shares of Tesla fell by around 4.5% after the company joined the S&P 500 index. Shares of Apple fell by close to 1.2% after the company said that it would close all its California-based stores temporarily due to Covid-19 pandemic.

US Stocks Performance*

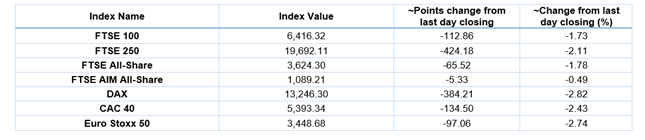

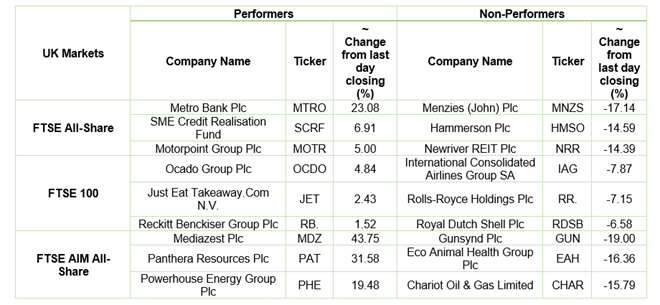

European News: The London and European markets traded in the red amid several factors like rise in Covid-19 cases, UK travel ban and border chaos. The UK shopper numbers witnessed a jump of 2.3% for the week ended on 19 December 2020 in comparison to the previous week. Among the gaining stocks, Shares of Metro Bank surged about 25.1% after it agreed to sell a mortgage portfolio to the Natwest Group in a lucrative deal of £3.1 billion. Ocado Group gained by around 6.1% after getting benefitted from Covid-19 restrictions and lockdowns. Shares of Centamin grew by approximately 1.6% due to an increase in gold prices. Among the decliners, Frasers Group was down by about 10.4% after the company said that it was pulling back its full-year guidance due to closure of its non-essential stores in response to the new wave of Covid-19 pandemic. Natwest Group fell by around 4.9% after the company acquired a mortgage portfolio of £3.1 billion. Shares of International Consolidated Airlines Group dropped the most on the FTSE-100 index.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 21 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in red*: Energy (-6.04%), Financials (-3.09%) and Real Estate (-2.50%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $50.44/barrel and $47.56/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,883.30 per ounce, down by 0.30% against the prior day closing.

Currency Rates*: GBP to USD: 1.3361; EUR to GBP: 0.9153.

Bond Yields*: US 10-Year Treasury yield: 0.935%; UK 10-Year Government Bond yield: 0.210%.

*At the time of writing