Global Markets: Shares at the Wallstreet leapt up in the Tuesdayâs market session, with the Dow Jones Industrial Average surged by 426.97 points or 1.72% against the yesterdayâs session and quoting at 25,246.75, the broader index S&P 500 Index added 46.57 points or 1.70% and trading at 2,791.02 and the technology benchmark index Nasdaq Composite was up by 156.62 points or 2.14% against the yesterdayâs closing level and quoting at 7,489.64, at the time of writing.

Global News: After US Central Bank's Chairman Jerome Powell's remarks hinted the possibility of a rate cut, stock indexes climbed on Tuesday while yields on 10-year US Treasuries moved higher. Despite a diplomatic push by Mexican authorities to avoid the looming levies on all Mexican goods imported to the United States, President Donald Trump on Tuesday said he would probably order new tariffs as the talks might not be enough.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 29.49 points or 0.41% higher at 7,214.29, the FTSE 250 index snapped 130.99 points or 0.69% higher at 19,008.16, and the FTSE All-Share Index ended 17.03 points or 0.43% higher at 3,948.13 respectively. European benchmark index STOXX 600 ended 2.18 points or 0.59% higher at 372.67 respectively.

European News: Donald Trump heaped praise on the United States' closest ally, describing the US-UK relationship as "special", and promised Britain a "phenomenal" post-Brexit trade deal. As customers deferred investment in the face of Brexit uncertainty, Britain's construction industry had its worst month since March 2018, with construction Purchasing Managers' Index (PMI) declining to 48.6 in May.

London Stock Exchange (LSE)

Top Performers Stocks: BAKKAVOR GROUP PLC (BAKK), VP PLC (VP.), and MARTIN CURRIE ASIA UNCONSTRAINED TRUST PLC (MCP) surged by 10.17 per cent, 10.14 per cent and 9.43 per cent respectively.

Top Laggards Stocks: THOMAS COOK GROUP PLC (TCG), CLIPPER LOGISTICS PLC (CLG), and AO WORLD PLC (AO.) decreased by 15.34 per cent, 9.61 per cent and 9.09 per cent respectively.

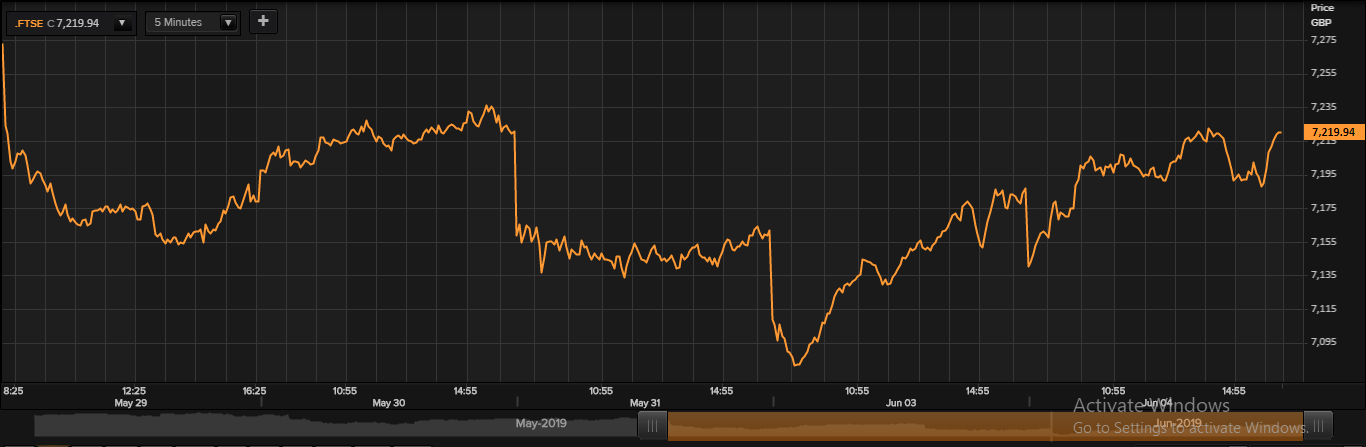

FTSE 100 Index

FTSE100 Index: 5-days Price Chart as on June 04, 2019. (Source: Thomson Reuters)

Top Risers Stocks: STANDARD LIFE ABERDEEN PLC (SLA), AVIVA PLC (AV.) and IMPERIAL BRANDS PLC (IMB) rose by 5.36 per cent, 3.65 per cent and 3.58 per cent respectively.

Top Fallers Stocks: OCADO GROUP PLC (OCDO), HARGREAVES LANSDOWN PLC (HL.) and PEARSON PLC (PSON) reduced by 5.04 per cent, 4.58 per cent and 2.76 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and BARCLAYS PLC.

Top Risers Sectors: Telecommunications Services (+3.10%), Financials (+1.29%), and Basic Materials (+0.49%).

Top Fallers Sectors: Technology (-0.92%), Utilities (-0.75%) and Healthcare (-0.30%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2706 and 0.8860 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.123% and 0.905% respectively.Â

*At the time of writing