US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 42.61 points or 0.99 per cent higher at 4,363.43, Dow Jones Industrial Average Index surged by 442.54 points or 1.29 per cent higher at 34,864.47, and the technology benchmark index Nasdaq Composite traded higher at 14,674.40, up by 114.60 points or 0.79 per cent against the previous day close (at the time of writing – 11:55 AM ET).

US Market News: The major indices of Wall Street traded in a green zone as the situation turned normal in the overbought bond markets. Among the gaining stocks, General Motors (GM) shares grew by about 4.16% after Wedbush had upgraded the stock to “Buy”. Bank of America (BAC) shares rose by about 3.29% after bond yields rebound on Friday morning. Levi Strauss (LEVI) shares went up by about 1.32% after the Company had beaten consensus forecasts for quarterly revenue and earnings. Norwegian Cruise Line Holdings (NCLH) shares grew by around 1.21% as airline stocks gained after sliding down in the previous trading session amid concerns regarding economic slowdown.

UK Market News: The London markets traded in a green zone after the release of various macroeconomic indicators. Moreover, the UK economic recovery slowed down during May 2021 as UK GDP had shown a monthly growth of around 0.8% during May 2021, while it rose by 2.0% in the prior month. Furthermore, the Office for National Statistics had shown a marginal drop of about 0.1% in manufacturing production and growth of around 0.8% in industrial production during May 2021 on a monthly basis.

FTSE 250 listed Vectura Group shares climbed by around 14.01% after it had received a takeover offer from Philip Morris worth approximately 1.045 billion pounds.

Omega Diagnostics shares rose by around 3.05% after the Company responded to a press release issued by the UK Rapid Test Consortium (UK RTC).

Outsourcer Bunzl shares went up by around 3.61% after the Company was upgraded to “Buy” by Berenberg. Similarly, Burberry shares went up by around 3.82% after Goldman Sachs had upgraded the stock to “Buy”.

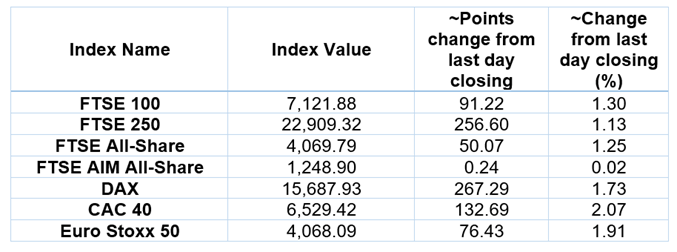

European Indices Performance (at the time of writing):

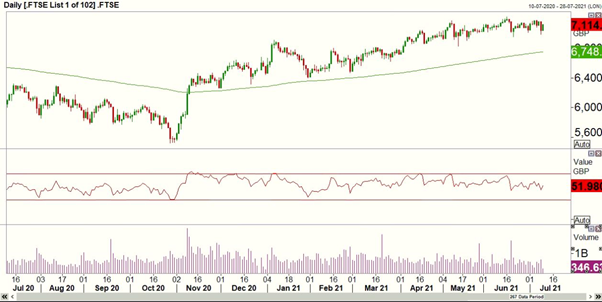

FTSE 100 Index One Year Performance (as on 9 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Basic Materials (+3.52%), Real Estate (+2.12%) and Financials (+1.69%).

Top Sector traded in red*: Technology (-0.13%).

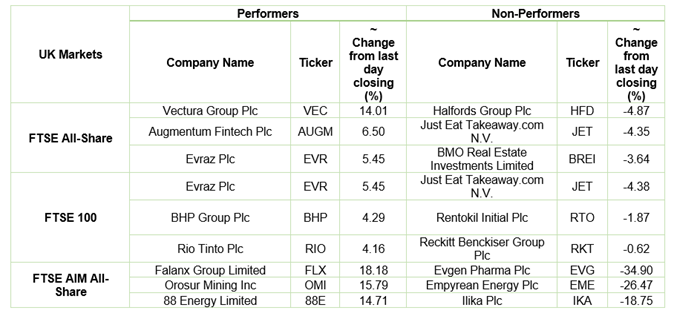

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $75.66/barrel and $74.62/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,811.40 per ounce, up by 0.62% against the prior day closing.

Currency Rates*: GBP to USD: 1.3880; EUR to GBP: 0.8555.

Bond Yields*: US 10-Year Treasury yield: 1.356%; UK 10-Year Government Bond yield: 0.6610%.

*At the time of writing