US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 20.09 points or 0.46 per cent higher at 4,407.20, Dow Jones Industrial Average Index surged by 161.75 points or 0.46 per cent higher at 34,999.91, and the technology benchmark index Nasdaq Composite traded higher at 14,713.40, up by 32.30 points or 0.22 per cent against the previous day close (at the time of writing – 12:15 PM ET).

US Market News: The major indices of Wall Street traded in a green zone boosted by the positive corporate announcements. Among the gaining stocks, Under Armour (UAA) shares surged by about 6.34% after the Company had raised its full-year forecast post delivering impressive quarterly results. Eli Lily (LLY) shares rose by about 4.43%, although the Company’s quarterly earnings fell short of the consensus estimates. Among the declining stocks, Clorox (CLX) shares dropped by about 10.50% after the Company had posted a decline in quarterly sales. Marriott (MAR) shares went down by around 2.15%, even after the Company had reported quarterly earnings more than the consensus estimates.

UK Market News: The London markets traded in a green zone driven by the flurry of positive corporate updates, particularly from BP and Standard Chartered.

BP shares climbed by about 5.82% after the Company had swung to second-quarter profit. Moreover, the Company had expected share buyback of around USD 1 billion each quarter and would increase the dividend over the next five years.

Standard Chartered shares went up by around 0.98% after the Company had witnessed a significant jump in the first-half profits and resumed dividend payments amid hopes of economic recovery.

Fresnillo had shown a healthy growth of around 59% in EBITDA during H1 FY21. Moreover, it had also announced a decent jump in the interim dividend. Furthermore, the shares rose by around 1.91%.

Domino’s Pizza shares grew by around 2.31% after the Company had posted a 28% jump in the first-half pre-tax profit and increased the share buyback.

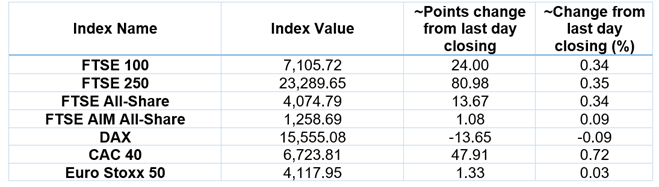

European Indices Performance (at the time of writing):

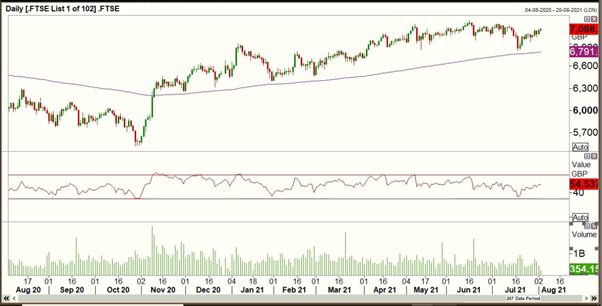

FTSE 100 Index One Year Performance (as on 3 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Energy (+1.71%), Basic Materials (+0.78%) and Healthcare (+0.21%).

Top 3 Sectors traded in red*: Real Estate (-1.04%), Consumer Cyclicals (-0.88%) and Industrials (-0.33%).

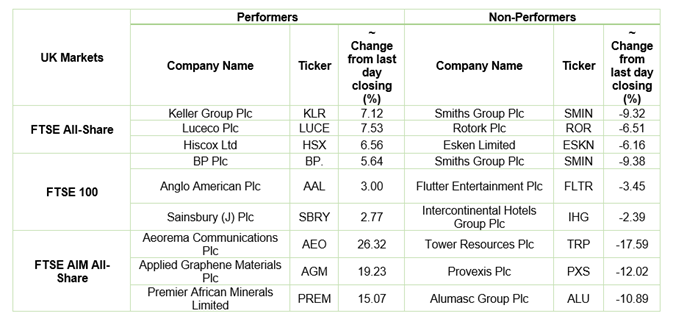

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $72.36/barrel and $70.50/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,813.45 per ounce, down by 0.48% against the prior day closing.

Currency Rates*: GBP to USD: 1.3912; EUR to GBP: 0.8528.

Bond Yields*: US 10-Year Treasury yield: 1.177%; UK 10-Year Government Bond yield: 0.5155%.

*At the time of writing