Summary

- Pound remained volatile as Britain and the EU move towards a favourable Brexit deal

- Negotiators from both sides try to address the gaps before the leadership meet scheduled for 15 October

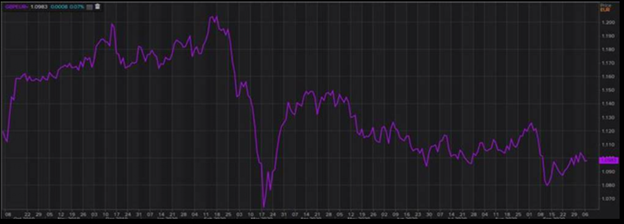

The Pound Sterling to Euro rate showed wide fluctuations on Tuesday 6 October 2020 with various contradictory off-record rumors regarding the stances of both parties for the ongoing Brexit deal negotiations.

While some sources said that EC (European Commission) officials felt that they were getting closer and closer to a deal, others lamented that the EU (European Union) industries might need to get prepared for a harmful economic split in 2021. Bilateral trade worth close to £1 trillion is involved between Britain and the EU member nations.

On the one hand, two EU diplomats mentioned that in most of the areas of social security rights, the UK’s proposals are being welcomed by the Commission and are under consideration.

On the other hand, a UK official pointed out that Britain wanted EU to provide for healthcare benefits to family members of UK citizens, but has not got a green signal on the same.

At the same time, a member of the European Parliament’s fisheries committee informed that they would not allow any yearly quota negotiations to take place, which is desired by the UK. EU wishes for unhindered rights to fish in the UK waters. France is going to be the biggest beneficiary of the fishing rights and is adamant not to change the EU stance, sources shared.

Nonetheless, some sources mentioned that there could be a possibility of a softer EU stand and internal talks are going on for the same.

Market experts confirmed that these conflicting headlines were the probable source of wide fluctuations in the Pound Sterling’s value during the day.

The monthly leaders’ summit of the European Union is scheduled to take place on 15 October 2020 at Brussels.

GBP/EUR exchange rate

During the past 52 weeks, the GBP/EUR exchange rate’s low / high were recorded to be 1.0523 (19 March 2020) and 1.2081 (13 December 2019) respectively. On 7 October at 2.07 PM, the rate was recorded to be 1.0944.

GBP/EUR exchange rate fluctuations on 6 October 2020

(Source: Thomson Reuters)

There were wide intra-day fluctuations on 6 October 2020, as can be seen from the above exchange rate graph for the day.

Foreign exchange specialists said that Brexit will continue to remain a prime driver for the volatility of pound sterling in the near future, especially because the size of the economic and social impact on both sides remains huge.

Ninth round summary

The ninth and the final round of free trade negotiations took place between the UK and the EU between 29 September and 2 October 2020 at Brussels.

The round concluded with few areas of convergence between the UK and the EU. These involved selected goods, services, investments, and nuclear cooperation.

There were also some conclusive developments regarding aviation, individual rights, judiciary, and social security.

However, there was a lack of progress on the areas of climate change, carbon price, and data protection.

EU said that it was crucial to arrive at a consensus on matters of fisheries, state aid, and governance during the coming few weeks.

Political analysts felt that the ninth round ended of a positive note, despite areas of divergence. They said that there are 50 per cent chances of a mutually beneficial deal taking place between the two negotiators before the end of 2020.

If an FTA (free trade agreement) comes through, it will go for approval in the respective parliaments of both the regions. Then it will come into effect on 1 January 2021.

Backdrop

Earlier in September 2020, the UK government has passed a controversial legislation named the Internal Market Bill. The EU said that it breached the international law as it amounted to amending the Brexit Withdrawal Agreement signed by the UK government in January 2020.

UK PM Boris Johnson is slated to talk to Ursula von der Leyen, President, European Commission soon over this.

It’s also a fact that while both the sides do want a favourable deal, but the time is running out.

Johnson’s spokesperson said that the country needed clarity on the deal as its businesses have to ready themselves accordingly. Earlier, the deal was targeted to conclude by the end of October but now the deadline is stretched to mid of November 2020.