FTSE 100 likely to open in green as GBP holds 31-month high vs USD

UK stock markets are expected to start on a positive footing on Monday, 4 January, the first trading day of new year 2021, following the restored strength of the Great Britain pound (GBP) against the United States dollar (USD). The pound sterling has been able to retain its 31-month peak following the elongated weakness in the greenback.

The UK stock markets closed in red in the half-day session of the holiday-shortened New Year’s week on Thursday, 31 December, with the benchmark FTSE 100 finishing off with a decline of a little over 14 per cent on a year-to-date (YTD) scale.

GBP strengthens further

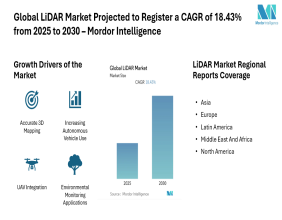

The GBP vs USD pair furthered the gains on Monday morning with a unit pound sterling equalling 1.3699 US dollars. At around 0709 GMT, the GBP to USD pair was trading at 1.3694, up 0.17 per cent from the previous close of 1.3671. The BoE had fixed a currency conversion rate of 1.3608 USD against a unit of GBP on 30 December.

GBP vs USD (4 January 2021)

(Source: Refinitiv, Thomson Reuters)

Markets ahead

With the finalisation of a conclusive trade arrangement between the Downing Street administration and the European Union, a renewed gush of optimism was seen amidst the investors. Going ahead, the market participants and policymakers will be glued to see how the provisional trade agreement between the United Kingdom and partner European countries unfolds.

However, the still uncontrollable rise in the coronavirus cases and subsequently spiralling number of hospital admissions have repeatedly resurfaced the jittery. The persisting situation of the nation with regard to the global health emergency has deteriorated in the recent past after the mutated strain of coronavirus was identified. The condition seemed to have worsened after the removal of stricter restrictions.

The soaring number of coronavirus cases in Ireland’s jurisdiction has been critical for the United Kingdom administration with the former breaching the mark of 100,000 confirmed cases of Covid-19. With the availability of the Oxford/AstraZeneca coronavirus vaccine and the arrival of the next batch of Pfizer/BioNTech vaccine, a couple of forthcoming weeks will remain noteworthy for the country.

The position of coronavirus cases in the United Kingdom after a month from now is likely to dictate the market direction and businesses will have a clearer view over their prospective receivables in the imminent quarters. The new year 2021 being termed as the possible year of recovery, the comprehensive outcome and guidance provided by the government and the Bank of England (BoE) in its upcoming MPC actions will be significant for the financial markets.

Commodity check

Meanwhile, in the commodities market, the safe-haven assets continued to register gains with the gold witnessing a sharp surge in the prices as the greenback suffered a major setback on the first trading day of the new year. An ounce of yellow metal was trading at $1,923.76, up 1.58 per cent from the previous close of $1,893.81 at 0716 GMT. A largely similar rising streak was observed in the energy market with the Brent crude oil trading 2.37 per cent higher at $53.03 and a barrel of WTI crude oil trading at $49.58, up 2.18 per cent.