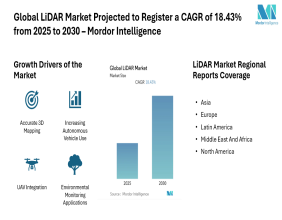

FTSE 100 hits 10-month high; HSBC (LON:HSBA), BP (LON:BP) gain up 8%

UK stock markets spearheaded the European markets with the benchmark FTSE 100 hitting a 10-month high on Wednesday, 6 January, while Great Britain pound (GBP) suffered a marginal setback against the United States dollar (USD). The FTSE 100 index gained more than 3 per cent in the terminal hours of the trading with the heavyweight stocks of HSBC Holdings Plc (LON: HSBA) and BP Plc (LON: BP) rising up to 8 per cent.

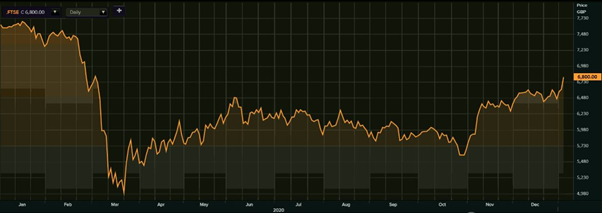

FTSE 100 @ 10-month high

The London equities went ahead in the trade even with England witnessing the day two of the third national lockdown. The revitalised hopes over the vaccination programme have seemingly outnumbered the fears of the third lockdown. The Democratic party win in Georgia has triggered a fresh rally in the financial markets with the EUR vs USD pair rising to a fresh 52-week high.

According to the latest trading data available with the London Stock Exchange, the FTSE 100 surged as much as 218.89 points, or 3.31 per cent to a 10-month high of 6,831.14 from the previous closing of 6,612.25. The headline index last made a high of 6,834.12 on 5 March 2020.

FTSE 100 (1-year performance)

(Source: Refinitiv, Thomson Reuters)

The broader stock market indices also followed suit barring FTSE 250. The FTSE All-Share index rose 2.79 per cent to a day’s high of 3,854.19, FTSE 350 added 2.87 per cent to an intraday top of 3,776.33, while FTSE 250 managed to gain 1.08 per cent to a day’s peak of 20,940.69.

Heavyweights lead

Several large-cap shares provided the major positive points to the FTSE 100 index on 6 January. Shares of the stock of HSBC Holdings amassed a gain of 8.09 per cent to hit almost a two-week high of GBX 409.25 from the previous closing price of GBX 378.60.

At around 1425 GMT, HSBC Holdings’ share price was trading 7.38 per cent higher at 406.55, while the stock of BP was trading at GBX 289.97, up 6.41 per cent. During the day so far, BP share price has registered an intraday high of GBX 291, up 6.79 per cent from the previous market price of GBX 272.50 as on 5 January.

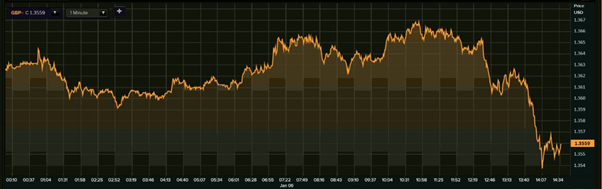

GBP drops vs USD

The GBP vs USD pair retreated sharply from the multi-year highs in the late afternoon deals. As per the latest data, the GBP to USD pair was trading at 1.3552, down 0.52 per cent from the previous close of 1.3624. During the day, the currency pair touched a low and high of 1.3539 and 1.3671, respectively. The Bank of England had fixed a reference foreign exchange conversion rate of 1.3593 USD and 1.1074 EUR against a unit of pound sterling on 5 January.

GBP vs USD (6 Jan)

(Source: Refinitiv, Thomson Reuters)