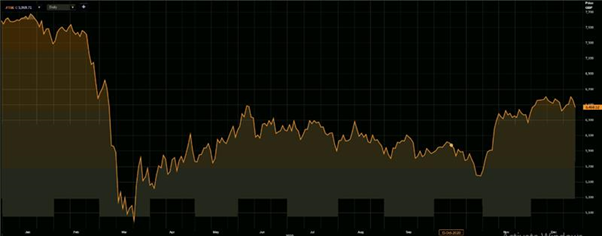

FTSE 100 slumps 14.3% in Covid’s 2020, records worst year since 2008 stock market crash

UK stock markets ended the Covid-19-led 2020 on a negative footing in a holiday-shortened week with the headline FTSE 100 index losing a little more than 14 per cent. With a year-to-date (YTD) drop of about 14 per cent, FTSE 100 is the second worst-performing benchmark index among the major European stock indices.

European snapshot

France’s CAC 40 and Italy’s FTSE MIB concluded the uncertainty-filled year with declines in a range of 5-7 per cent. However, Germany’s DAX, and SMI of Switzerland have finished the year in the positive territory with the DAX rising more than 3.5 per cent. Shockingly, Spain’s IBEX 35 has witnessed a relatively higher plunge as compared to FTSE 100 with the former losing 15.55 per cent at the close of trade.

FTSE 100 ends in red

On 31 December 2020 itself, the FTSE 100 collapsed as much as 95.30 points, or 1.45 per cent to 6,460.52 from the previous close of 6,555.82. According to the historical data available with the London Stock Exchange, the FTSE 100 index has wiped off 1,081.92 points, or 14.34 per cent in the calendar year 2020 to 6,460.52 from a level of 7,542.44 as on 31 December 2019.

(Source: Refinitiv, Thomson Reuters)

Pound sterling finishes at 31-month high

Interestingly, the British currency market has snapped the year in green with the pound sterling finishing off at a 31-month peak against the United States dollar. According to the latest foreign exchange data available, the GBP vs USD pair was trading at 1.3647, up 0.19 per cent at around 1356 GMT from the previous closing of 1.3622. The Bank of England had fixed a currency conversion rate of 1.3608 USD and 1.1063 EUR against a unit of pound sterling on 30 December.

Markets fail to sustain gains

Conclusively, the FTSE 100 index has failed to sustain the recent gains when the index soared nearly 2 per cent reacting to the development of the Downing Street administration securing free trade access to all the partner countries of the European Union in the Brexit negotiations. A market-wide gain was observed on Tuesday, 29 December, the first day of this week with the investors rejoicing at the outcome of the weeks-long deliberations with regard to a post-Brexit trade arrangement between the European Union and the United Kingdom.