US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 3.90 points or 0.09 per cent lower at 4,185.40, Dow Jones Industrial Average Index dipped by 32.80 points or 0.10 per cent lower at 33,948.77, and the technology benchmark index Nasdaq Composite traded lower at 14,107.63, down by 31.15 points or 0.22 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in negative territory as investors waited for the Federal Reserve's latest monetary policy meeting. Among the gaining stocks, United Parcel Service shares rose by approximately 11.70% after the parcel delivery Company had topped the quarterly revenue estimates. GameStop shares surged by around 6.65% after the Company had raised around USD 551 million to accelerate its shift to e-commerce. Among the declining stocks, General Electric shares fell by about 3.25% after the Company had reported around a 20% drop in quarterly profit. Eli Lilly and Co shares went down by about 1.85% after the drug-maker had posted around a 7% fall in quarterly profit.

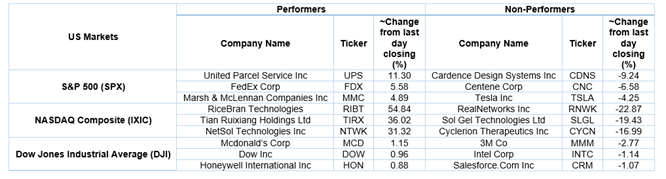

US Stocks Performance*

UK Market News: The London markets traded in a red zone illustrating weak investor sentiments regarding the rising number of coronavirus cases in India. FTSE 100 traded lower by around 0.26%, even after better-than-expected results from BP and HSBC Holdings.

HSBC Holdings shares rose by about 3.53% after the Company had shown a 79% growth in the first-quarter reported profit before tax because of an improved economic outlook after the vaccination rollout. Moreover, the adjusted profit before tax grew by 109% over the period.

British Energy Company BP had reported first-quarter profit better than expectations driven by higher oil prices. Moreover, the Company had hit its net debt target earlier than the expectations. Furthermore, the shares went up by around 0.89%.

Software firm Aveva Group shares plunged by about 5.76% after the Company’s reported full-year revenue remained flat year-on-year despite achieving double-digit revenue growth during the second half of the year. The Company remained the worst performer on the FTSE 100 index.

FTSE 100 listed Halma had acquired North Carolina-based PeriGen for the cash consideration of USD 58 million to be funded from the existing facilities. Moreover, the shares dropped by about 0.76%.

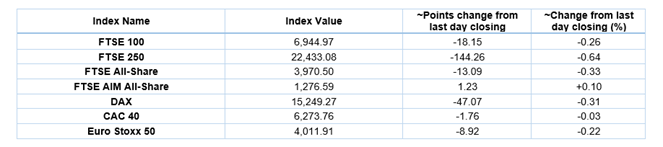

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 27 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Financials (+0.53%), Healthcare (+0.29%) and Utilities (+0.08%).

Top 3 Sectors traded in red*: Basic Materials (-1.18%), Energy (-0.88%) and Industrials (-0.76%).

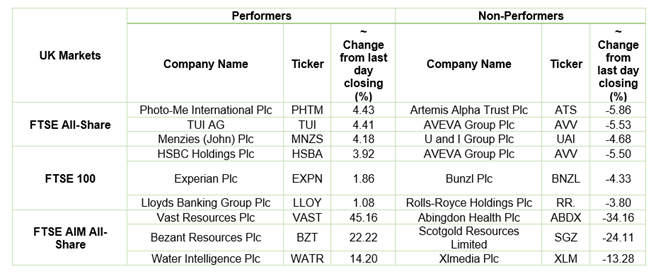

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $65.54/barrel and $62.52/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,775.75 per ounce, down by 0.24% against the prior day closing.

Currency Rates*: GBP to USD: 1.3904; EUR to GBP: 0.8688.

Bond Yields*: US 10-Year Treasury yield: 1.6181%; UK 10-Year Government Bond yield: 0.7770%.

*At the time of writing