UK Market: The UK stock market has plunged on Monday, tailing the global market selloff because of the heightened tension between Russia and Ukraine. The blue-chip FTSE 100 index is down by over 1.3%, while the mid-cap focused FTSE 250 index is down around 1.8%. Mining company Evraz Plc (-30.05%) was amongst the top losers on the FTSE100 index, as it has business operations in Russia and Ukraine.

International Consolidated Airlines Group (LON: IAG): The passenger airlines company was down by over 4.5%, with a day’s low of GBX 159.46 amid rising tension between Russia and Ukraine. Many airlines have cancelled flights to the Ukraine region. Also, many countries have issued a travel advisory for their citizens.

Darktrace Plc (LON: DARK): The cybersecurity firm was down by over 7%, with a day’s low of GBX 370.40. The stock price witnessed profit booking amid a selloff in the technology sector. The company will be announcing its half-yearly results on 3 March 2022.

Fresnillo Plc (LON: FRES): The precious metal and mining company was up by over 6%, with a day’s high of GBX 665. The stock price was up today following the rise in gold prices in the international market.

US Markets: The US market is likely to open in negative territory as indicated by the global trend and futures indices. S&P 500 future was down by 8 points or 0.18% at 4,402, while the Dow Jones 30 future was down by 0.14% or 51 points at 34,579. The technology-heavy index Nasdaq Composite future was down by 0.27% at 14,202 (At the time of writing – 8:50 AM ET).

US Market News:

The defence contractor, Lockheed Martin (LMT), was up by 0.5% in premarket trading after the company cancelled its USD 4.4 billion deal to buy Aerojet Rocketdyne (AJRD). The acquisition deal has come under the regulatory lens and was blocked by the Federal regulator because of anti-competitive concerns.

The private equity firm, Blackstone (BX), was down by over 2.5% in premarket after the company announced a USD 6.3 billion acquisition deal to buy Crown Resorts, an Australian Casino operator.

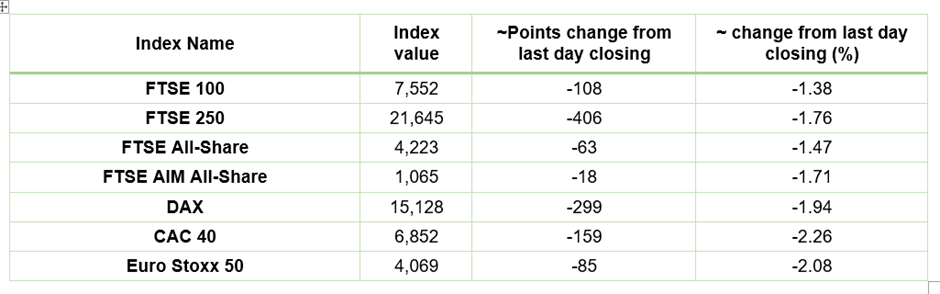

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 14 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), International Consolidated Airlines Group (IAG), BP Plc (BP.)

Top Sector traded in green*: Basic Materials (0.20%).

Top 3 Sectors traded in red*: Financials (-2.42%), Technology (-1.98%), Industrials (-1.75%).

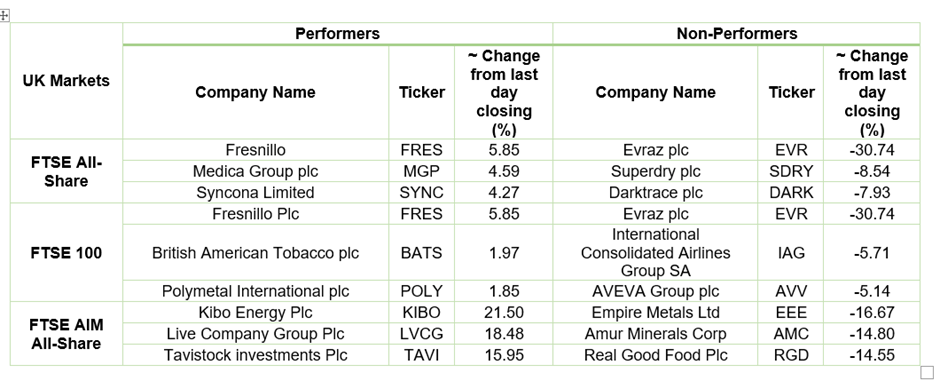

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $93.72/barrel and $92.50/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,863 per ounce, up by 1.15% against the prior day closing.

Currency Rates*: GBP to USD: 1.3529; EUR to USD: 1.1320.

Bond Yields*: US 10-Year Treasury yield: 1.970%; UK 10-Year Government Bond yield: 1.5235%.

*At the time of writing