US Markets: Wall Street started on a comfortable note on Thursday, 23 December, with all the three stock averages rising for the third consecutive day. Dow Industrials briefly retook the level of 36,000, technology heavy market index Nasdaq Composite gained nearly 1%, while the wider share indicator S&P 500 came closer to the record high of 4,743.83 as the index registered an intraday peak of 4,733.19 on Thursday.

The market participants have seemingly overruled the fears related to the sharp surge in Covid cases and the massive arrival of Omicron variant in the United States as the people infected with the new variant showed mild symptoms as compared to the health consequences associated with previously existing strains of Covid-19 (SARS-CoV-2) virus.

The confirmatory assistance from the Washington administration also relieved the investors as President Joe Biden indicated lower possibilities of reintroducing a lockdown.

A positive round of macroeconomic data also supported the equity framework in the US as personal income reported an increase of 0.4%, while personal spending grew by 0.6%. This has been the sixth straight gain in personal spending in the US. The volume of new orders for US-made durable goods surged 2.5% in November, while new home sales in the US recognised an increase of 12.4%, realising the highest reading since April this year. This has been the fastest rise in new home sales in seven months.

Meanwhile, a South African study confirming less severity of Omicron variant further helped in reinstating he lost confidence amidst the equity participants. However, the new strain continues to remain highly transmissible and dominant, in terms of overriding the highest possible immunity acquired through the double dose of Covid vaccine.

US markets will be shut on Friday, 24 December, on the account of Christmas Eve. In the holiday-shortened trading week, all the three Wall Street benchmarks are set to finish in the positive territory on a weekly basis with gains in the range of 1% to 4%.

The Dow Jones Industrial Average advanced 207.25 points, or 0.58% to 35,961.14, the tech leader Nasdaq Composite soared 145.40 points, or 0.94% to 15,667.29, whereas the broader share barometer S&P 500 added 32.31 points, or 0.69% to 4,728.87.

US Market News: Shares of Caterpillar, Dow, Honeywell International, Boeing, Walt Disney, 3M, American Express, Cisco Systems, Intel and Amgen emerged as the major gainers among the 30 heavyweight components of Dow Jones, with the stocks rising 1-3%. Market-wide buying was seen on Thursday, the last session before Christmas as only a handful of stocks witnessed marginal dips including Merck & Co, Visa, Walmart and Coca-Cola.

Across the technology peers on Nasdaq, shares of Tesla continued to recover for the third straight session on Thursday after the CEO and Co-founder Elon Musk said he’s almost done with stake sales. The stock of Tesla surged approximately 6%, taking the three-day gains to more than 18%, to an intraday high of $1,069.10 from the previous closing price of 1,008.87.

Shares of Micron Technology, Advanced Micro Devices, Xilinx, Comcast, MercadoLibre, Cintas, Honeywell International, CSX, Match Group, Facebook, Broadcom, Applied Materials, Peloton Interactive, Trip.com Group, ADP, Charter Communications, Twenty-First Century Fox, Skyworks Solutions, Bookings Holdings, Adobe Systems, Activision Blizzard, Cisco Systems, Regeneron Pharmaceuticals, Marriott International, Nvidia, Intel, ASML, Illumina, eBay and Amgen soared 1-5%, effectively supporting the market index from the front.

On the other hand, shares of Moderna extended the losses on Thursday with the stock crashing a little more than 5%. The stock recovered partly as the trading progressed. In the last four sessions, the stock of Moderna has lost 16% of its market capitalisation. Shares of JD.com, Pinduoduo, Zoom Video Communications and CrowdStrike Holdings collapsed 1-4%.

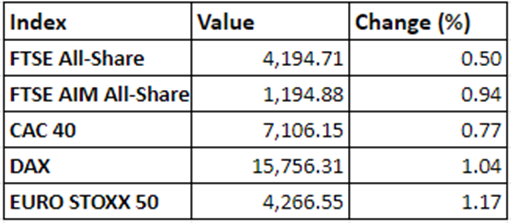

UK Markets: London equities staged a moderate upsurge on Thursday with the domestic benchmark index FTSE 100 finishing near the psychological level of 7,400 for the first time in the current month, just a day before the half-day session on Christmas Eve. The market index registered an intraday high of 7,385.42 as investors progressively accumulated the equities following the milder impact of the Omicron variant.

Shares of Melrose Industries, M&G, International Consolidated Airlines, Rolls-Royce Holdings and Flutter Entertainment emerged as the biggest gainers among the pack of 101-constituent heavy FTSE 100, with the stocks rising more than 2% each. On the contrary, stocks of Evraz, Dechra Pharmaceuticals, British American Tobacco, Hikma Pharmaceuticals and B&M European Value Retail shed 1-3%.

The headline FTSE 100 has mounted a six-week high on Thursday following the back-to-back rally as market participants have apparently rejected the damage due to the Omicron variant. The market index added 31.68 points, or 0.43% to conclude at 7,373.34, while the mid-cap counterpart gained 185.96 points, or 0.81% to finish at 23,266.75, after making a day’s high at 23,300.10.

FTSE 100 (23 December)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and Rolls-Royce Holdings

Top 3 sectoral indices: Automotive, Personal Goods, and Consumer Services

Bottom 3 sectoral indices: Medicine and Biotech, Tobacco and Food Products

Crude oil prices: Brent crude up 1.41% at $76.34/barrel; US WTI crude up 1.14% at $73.59/barrel

Gold prices: An ounce of gold traded at $1,811.15, up 0.50%

Exchange rate: GBP vs USD - 1.3413, up 0.48% | GBP vs EUR - 1.1835, up 0.44%

Bond yields: US 10-Year Treasury yield - 1.494% | UK 10-Year Government Bond yield - 0.9150%

Markets @ 16:30 GMT

© 2021 Kalkine Media®