US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 21.71 points or 0.57 per cent higher at 3,851.88, Dow Jones Industrial Average Index expanded by 251.49 points or 0.82 per cent higher at 30,975.09, and the technology benchmark index Nasdaq Composite traded higher at 13,659.93, up by 49.38 points or 0.36 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the green territory driven by better-than-expected US jobless claims data. The US Labor Department had reported initial jobless claims of 779,000 for the week ended on 30 January 2021 compared to 812,000 in its prior week. Among the gaining stocks, Canada Goose Holdings shares grew by 20.73% after it had reported revenue and profit more than the estimates. Shares of EBay went up by 9.58% after it had given strong financial guidance. Shares of PayPal Holdings jumped by 4.84% after it reported quarterly earnings more than the consensus estimate. Among the declining stocks, Qualcomm shares went down by 7.40% after it had warned of sales growth during the first half of 2021. Shares of GrubHub plunged by 3.65% after it reported a loss for the latest quarter.

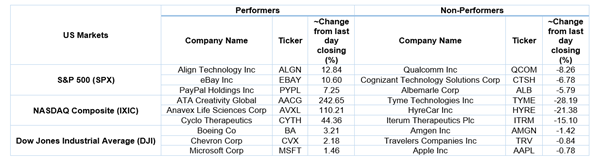

US Stocks Performance*

European News: The London and European markets traded in the mixed territory after the latest policy announcement from the Bank of England. The UK construction PMI had slipped to 49.2 during January 2021 against the forecasted figure of 52.9. Among the gaining stocks, Compass Group shares jumped by 4.19% after it had apologized for sub-standard free school meal packages. Barratt Developments shares jumped by 1.42% after it had declared an interim dividend. Watches of Switzerland shares went up by 1.40% after it released the third-quarter update. Shares of Whitbread had surged the most on FTSE 100. Among the decliners, Unilever shares went down by 4.31% after it reported a decline in its annual profit. Shares of BT Group went down by 3.65% after it reported a fall in third-quarter earnings.

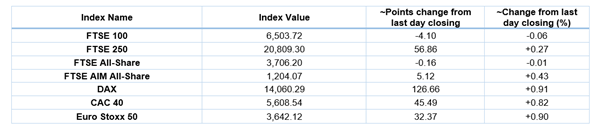

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 4 February 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Financials (+1.20%), Healthcare (+1.06%) and Consumer Cyclicals (+0.72%).

Top 3 Sectors traded in red*: Consumer Non-Cyclicals (-1.72%), Energy (-1.29%) and Utilities (-0.93%).

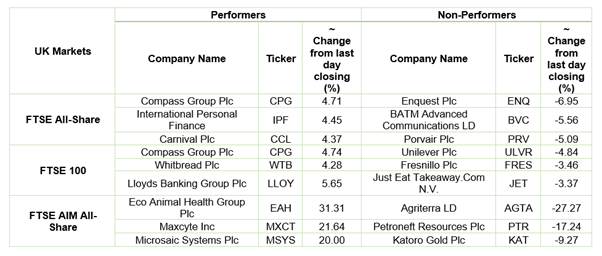

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $58.86/barrel and $56.30/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,790.50 per ounce, down by 2.43% against the prior day closing.

Currency Rates*: GBP to USD: 1.3657; EUR to GBP: 0.8758.

Bond Yields*: US 10-Year Treasury yield: 1.141%; UK 10-Year Government Bond yield: 0.446%.

*At the time of writing