US Markets: The three major Wall Street indices started on a positive note on Monday, 8 November, following the corporate earnings euphoria and cheerful jobs data with Dow Industrials registering a fresh record high, while the tech heavy benchmark Nasdaq Composite and S&P 500 oscillated near their respective all-time highs.

The market participants are looking forward to the inflation rate release in the present week. The US Bureau of Labor Statistics is set to reveal the rate of inflation for October on Wednesday, 10 November.

Of the major heavyweight corporations in the United States, shares of Tesla witnessed a major blow with the stock opening nearly 6% lower on Monday after the Twitter poll launched by Co-founder and CEO Elon Musk, asking to sell a 10% stake in electric car manufacturer, received 58% votes in favour of a potential stake sale. The investors hammered the shares in the pre-market deals with the stock touching a low below $1,140.

The Dow Jones Industrial Average advanced as much as 171.54 points, or 0.47% to 36,499.49, Nasdaq Composite witnessed a marginal uptick of 24.68 points, or 0.15% to 15,996.27, while the wider share indicator S&P 500 added 3.94 points, or 0.08% to 4,701.47. During the day so far, Dow Industrials has recorded a fresh all-time high of 36,565.73.

US Market News: Shares of Caterpillar, American Express, Visa, Walt Disney, Intel, Goldman Sachs, JPMorgan Chase and Dow rose more than 1% with the stock of Caterpillar rising over 3%, emerging as the lead gainer among the components of Dow Industrials. All the shares collectively boosted the market index, providing the maximum number of positive points on a cumulative basis.

On the other hand, the shares of Nike slipped more than 3% followed by declines in Procter & Gamble, Coca-Cola and Amgen partly counterbalanced the spike in index.

Amid the tech leader Nasdaq Composite, shares of Booking Holdings, Trip.com Group, Advanced Micro Devices, Nvidia, Xilinx, PayPal, NetEase, Skyworks Solutions, Intel, Marriott International, Align Technology, CDW, Workday and Netflix gained 1-8% on Monday, whereas shares of stocks of Peloton Interactive, Zoom Video Communications, Docusign, Pinduoduo, Tesla, CrowdStrike Holdings and Costco Wholesale cracked 2-9%.

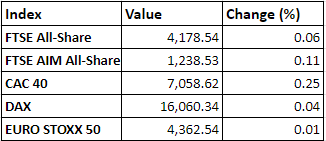

UK Markets: London equities hovered in a range-bound territory on Monday with the investors tip-toeing the markets, seemingly as they await any major development that can categorically impact the markets. Shares of Darktrace emerged as the biggest gainers among the 101-constituent heavy FTSE 100 with the stock rising 12%, emerging as the clear winner for the day.

The domestic market index FTSE 100 traded at 7,310.92, up 6.96 points, or 0.09% from the previous close of 7,303.96. The index failed to breach the previous 20-month high of 7,331.25 as the market participants eye a slew of macroeconomic numbers to be revealed on Thursday, 11 November.

The Office for National Statistics (ONS) will be publicising the balance of trade, preliminary estimate of GDP growth rate for July-September quarter, production metrics for industries and manufacturing, alongside the construction output for September of 2020 on Thursday. Meanwhile, the mid-cap indicator FTSE 250 shed 21.99 points, or 0.09% to 23,574.80, from the previous closing mark of 23,596.79. The index is over 1,200 points away from its 52-week high.

World markets near record highs

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, International Consolidated Airlines and Vodafone Group

Top 3 sectoral indices: Automotive, Precious Metals, and Industrial Transportation

Bottom 3 sectoral indices: Travel, Retailers and Real Estate Trusts

Crude oil prices: Brent crude up 0.53% at $83.18/barrel; US WTI crude up 0.52% at $81.69/barrel

Gold prices: An ounce of gold traded at $1,823.85, up 0.39%

Exchange rate: GBP vs USD - 1.3573, up 0.59% | GBP vs EUR - 1.1708, up 0.36%

Bond yields: US 10-Year Treasury yield - 1.485% | UK 10-Year Government Bond yield - 0.8575%

Markets @ 15:35 GMT