UK stocks seemingly were stalled in the mid-morning deals on Wednesday, 20 January, ahead of the inauguration ceremony of President-elect Joe Biden later in the day. The inauguration ceremony is slated to happen under stern security arrangements following the Capital Hill backlash earlier this month.

Investors await Biden’s inauguration

Investors have already factored in the prospects of Joe Biden becoming the new US President, while the recently announced stimulus of $1.9 trillion has apparently failed to lift the Dow Industrials after Fed chair Janet Yellen warned the congress of a deeper recession.

After the much gung-ho around Donald Trump not acknowledging the defeat in US presidential elections, Biden is finally scheduled to be sworn in as the 46th President of the US.

The Federal Bureau of Investigation (FBI) has been provoked to install all the 25,000 National Guard troops for the oath taking ceremony set to be conducted at the West front of the Capitol Hill. The present number of national guards to be present around Capitol Hill is nearly two times more than the previous swearing in ceremonies.

Local jittery continues

At the domestic front, the ongoing vaccination programme and the still spiking coronavirus cases in the UK have kept investors tight-lipped with the London equities oscillating in a narrow range since the beginning of this week. The restated fears of further restrictions over and above the national lockdown have hurt the investors’ sentiments in the recent past.

Markets slipped from the day’s peak after beginning marginally higher with the December consumer price index-based inflation coming in at 0.6 per cent.

At around 10:00 GMT, the benchmark FTSE 100 was trading at 6,729.12, up 16.17 points, 0.24 per cent from the previous close of 6,712.95. The broader market indices including the FTSE 350 and FTSE All-Share were trading 0.4 per cent higher, whereas FTSE 250 was trading 0.91 per cent higher.

FTSE 100 (20 Jan)

(Source: Refinitv, Thomson Reuters)

December inflation swells to 0.6%

According to the Office for National Statistics (ONS), the inflation rose to 0.6 per cent in the year to December from 0.3 per cent in November with alcohol and tobacco, clothing and footwear, transport, and recreation and culture contributing majorly to the rise.

While food and non-alcoholic beverages contributed the most on the negative side. The sharp spike in air fares in November-December period, partially due to costlier fuel prices and the festive season, steered the rise in transport component of inflation.

Gainers and losers

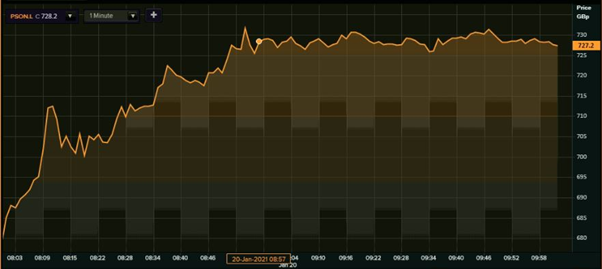

Shares of Pearson Plc (LON:PSON), the London-headquartered publishing company, topped the 101 constituents of FTSE 100 on Wednesday, while the stock of London-based banking giant Standard Chartered Plc (LON: STAN) emerged as the top laggard. The stock of Pearson rose as much as 7.75 per cent to a day’s high of GBX 731.60 from the previous closing of GBX 679.

Pearson (20 Jan)

(Source: Refinitv, Thomson Reuters)

While the Standard Chartered share price crashed a little more than 4 per cent to a day’s bottom of GBX 457.40 from the last market price of GBX 476.60. Other than Pearson, shares of the Basingstoke-headquartered fashion apparel and accessory maker Burberry Group Plc (LON: BRBY) rose nearly 6 per cent. On the other hand, the stock of National Grid (LON: NG) tripped more than 1.8 per cent.