US Markets: All the three stock indices of America started on a negative footing on Wednesday, 10 November, with the tech heavy Nasdaq Composite leading the losses after the US CPI inflation jumped to 6.2%.

This has been the highest level for CPI based inflation rate since November of 1990. The CPI inflation hitting a 31-year high has sombred the mood of investors as the corporate earnings momentum has moderated with most of the heavyweight corporations looking forward to operating at maximum scale in the present quarter. Higher costs of energy, food, and used vehicles have collectively steered the inflation rate over the street estimates.

Meanwhile, the number of US citizens seeking unemployment benefits dropped further in the week ending 6 November to 267,000, hitting a fresh low since March of 2020. The gradual improvement in the employment landscape has considerably supported the national economy with the businesses restarting their operations after an elongated stretch.

Must Know Global Cues before the ASX Opening Bell

However, the inflationary hurdles for enterprises are likely to stretch beyond the anticipated time as the rate of inflation has been on a rising run. Following this, businesses would increasingly pass on the higher prices to consumers to counterbalance their respective losses, a move that can affect the retail sales.

Dow Jones Industrial Average dropped 28.46 points, or 0.08% to 36,288.04, Nasdaq Composite shed 47.51 points, or 0.27% to 15,844.18, while the broader share barometer S&P 500 declined 4.37 points, or 0.09% to 4,681.08.

US Market News: Shares of Nike, Apple, Microsoft, Goldman Sachs and UnitedHealth Group were the major losers among the 30-constituent heavy Dow Industrials, providing the major negative points to the index. The stock of American Express, Cisco Systems, Visa, Amgen, Walgreens Boots Alliance jumped up to 2%, partly offsetting the losses for the market index.

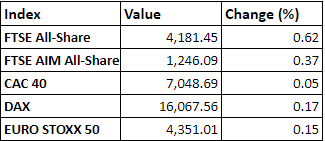

UK Markets: London equities strengthened on Wednesday as the trading progressed with the domestic benchmark FTSE 100 nearing its 20-month high. Investors are keenly awaiting the preliminary estimates for third quarter GDP growth, scheduled to be released on Thursday.

Shares of ITV emerged as the lead gainers among the 101 components of the headline index, rising as much as 14% after the London-headquartered media corporation provided a better outlook while announcing the July-September quarter financial results.

The blue-chip shares of AstraZeneca, Reckitt Benckiser, GlaxoSmithKline, Lloyds Banking Group, Diageo, National Grid and Barclays thoroughly supported the index. FTSE 100 advanced 45.24 points, or 0.63% to 7,319.72, whereas the mid-cap reflector FTSE 250 rose 89.61 points, or 0.38% to 23,456.13.

FTSE 100 (10 November)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Rolls-Royce Holdings and Barclays

Top 3 sectoral indices: Precious Metals, Retailers and Food Products

Bottom 3 sectoral indices: Personal Goods, Medical Services and Engineering Products

Crude oil prices: Brent crude down 0.33% at $84.50/barrel; US WTI crude down 0.59% at $83.69/barrel

Gold prices: An ounce of gold traded at $1,859.45, up 1.56%

Exchange rate: GBP vs USD - 1.3483, down 0.52% | GBP vs EUR - 1.1703, up 0.11%

Bond yields: US 10-Year Treasury yield - 1.514% | UK 10-Year Government Bond yield - 0.8900%

Markets @ 15:32 GMT

.jpg)