US Markets: The US market is likely to make a flat start, as indicated by the future index movement. S&P 500 future was down by 2 points or 0.05% at 4,659, while the Dow Jones 30 futures was down by 0.05% or 19 points at 35,933. The technology-heavy index Nasdaq Composite future was down by 0.18% at 15,579 (At the time of writing – 8:50 AM ET).

US Market News:

Shares of the electric carmaker Tesla (TSLA) rose by 0.9% in premarket trading after the company sold 70,847 electric vehicles in December, which were manufactured in China. It is the highest single-month sales for the company since it started production in China in 2019.

Shares of the Vir Biotechnology (VIR) rose nearly 9% in premarket after the United States bought additional 600,000 doses of antibody vaccines which the company manufactures along with UK-based partner GSK.

Shares of the chipmaker Intel (INTC) rose nearly 1.1% after the company appointed David Zinsner as its new CFO and executive vice president.

UK Market News: The UK stock market trades in a positive territory, recovering some ground after yesterday’s fall. Amongst top gainers is investment firm, Scottish Mortgage Investment Trust Plc (4.39%). The shares of the tech investment firm were trading up after recovery in the US technology-heavy Nasdaq index. The mid-cap focused FTSE250 index was up by 0.45%.

Harvest Minerals Ltd (LON:HMI): Shares of the mineral exploration company were up by over 29%, with a day’s high of GBX 6.75. The stock price continues to show positive momentum following the announcement of growth in sales performance during the fourth quarter. The share price is up by over 43% since the start of the new year.

Darktrace Plc (LON: DARK): Shares of the cybersecurity firm were up by over 10%, with a day’s high of GBX 495.20 after the company announced its business update for the six months to 31 December 2021. The firm reported a 39.6% growth in the number of customers and expects at least 50% growth in revenue.

Shoe Zone Plc (LON: SHOE): Shares of the foot retailer were up by over 17%, with a day’s high of GBX 142.50 after the company returned to profitability for the financial year ended 2 October 2021. The profit before tax stood at £9.5 million.

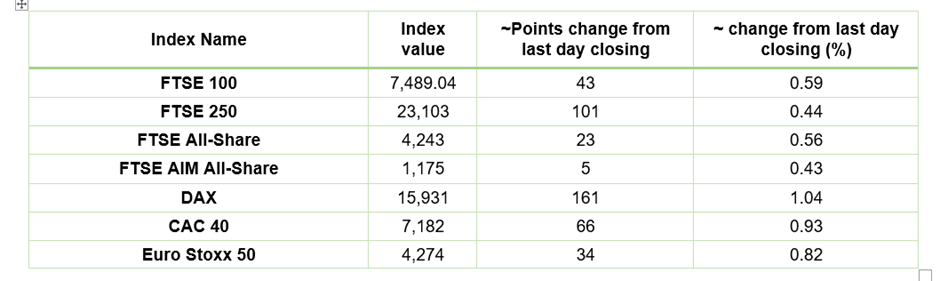

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 11 January 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BHP Group Plc (BHP)

Top 3 Sectors traded in green*: Energy (1.45%), Consumer Cyclicals (1.42%), Healthcare (1.12%),

Top 2 Sectors traded in red*: Consumer Non-Cyclicals (-0.19%), Real Estates (-0.47%)

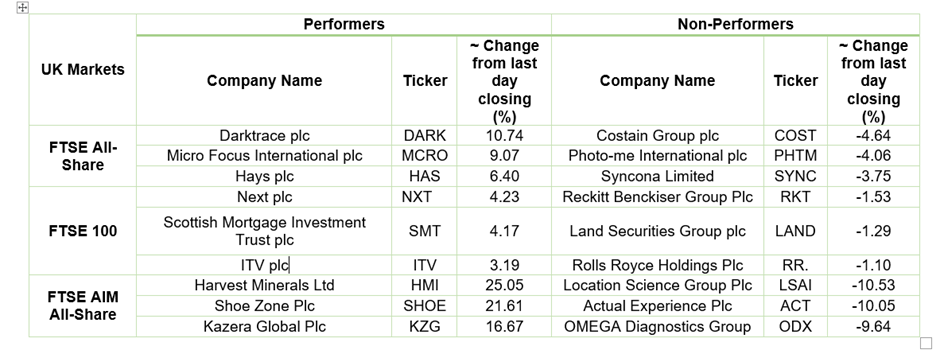

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $82.38/barrel and $79.84/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,801 per ounce, up by 0.17% against the prior day closing.

Currency Rates*: GBP to USD: 1.3571; EUR to USD: 1.1325.

Bond Yields*: US 10-Year Treasury yield: 1.778%; UK 10-Year Government Bond yield: 1.1835%.

*At the time of writing

.jpg)