US Markets: The major Wall Street stock averages are set to begin on a flat-to-moderately higher note on Monday, 13 December, as fears with regards to the eruption of Omicron cases have materially unsettled the market participants with the UK reporting more than 1,100 cases on Sunday, taking the total number of confirmed to over 3,100.

Markets have seen massive wipeout in the combined market capitalisations in the current calendar year following the sharp rise in the cases, any major disruption on the back of Covid-19 as pandemic continues to handhold equities.

With the ever-evolving course of coronavirus, mutating variants, and rapidly spreading sub-lineages of the virus, the healthcare authorities are also baffled as the virus continues to affect the double-jabbed individuals, the people having the so-called maximum protection against the virus.

The December futures linked to the Dow Jones Industrial Average erased all the gains in the terminal deals of the pre-open session. Since 1 December, the Dow Industrials have managed to amass a gain of nearly 6% following the recovery from the Black Friday’s market mayhem and subsequent sessions of losses after the World Health Organisation warned about the severe consequences of the Omicron variant.

The market participants are also likely to stay cautious as the US Federal Reserve’s Federal Open Market Committee (FOMC) is due to deliver its last policy decision for 2021, providing the indication of an interest rate hike and the extent of prospective tapering with regards to its bond buying programme.

Among the other macroeconomic data points in the current week, the US Department of Labor is due to declare the producer prices for the month of November, while the US Census Bureau is set to reveal the retail sales, housing starts and building permits for November of 2021.

Meanwhile, the rate of inflation escalating to 39-year high failed to increase the jittery as market participants brushed off the inflationary concerns for now, as the outcome was well within the pre-defined estimates.

The annual rate of inflation in the US in November jumped to 6.8%, this is the highest reading since June 1982. With the inflation rate boiling month-after-month, the policy makers at the US Federal Reserve are likely to consider increasing the tapering speed of bond purchases, the move expected to calm the rate as inflationary hurdles are no longer momentary as anticipated initially.

US Market News: Technology stocks trading higher in the early hours of pre-open pared gains just before the opening bell. Though the gains in major tech peers outnumbered the rise in shares of other conventional heavyweight corporations. The tech-heavy Nasdaq Composite is expected to lead the markets on Monday.

The December 21 futures of Nasdaq Composite traded 49.50 points, or 0.30% higher at 16,379.25, effectively outperforming the Dow Industrials.

UK Markets: Witnessing a subdued start to Wall Street on Monday, the UK shares corrected further in the terminal deals with the domestic benchmark index FTSE 100 dropping well below the psychological level of 7,300. The headline index plunged 0.63% to 7,262.98 in the late afternoon trades, from the intraday high of 7,309.23.

The losses of mid-cap heavy market index FTSE 250 were higher as compared to the leading indicator. FTSE 100 traded 157.14 points, or 0.69% lower at 22,770.57, it shed nearly 1% to 22,758.69 from the day’s peak of 22,981.67.

Among the blue-chip components of FTSE 100, shares of Fresnillo emerged as the biggest gainers, rising 3%, while the stock of International Consolidated Airlines collapsed the most with the components losing more than 4%.

As far as the heavyweight constituents were concerned, the stocks of AstraZeneca, Unilever, HSBC Holdings, GlaxoSmithKline, Royal Dutch Shell, BP, British American Tobacco, Relx, Reckitt Benckiser, Prudential, London Stock Exchange Group and Lloyds Banking Group declined up to 3%, dragging the index further into the negative region.

FTSE 100 (13 December)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and Rolls-Royce Holdings

Top 3 sectoral indices: Industrial Engineering, Industrial Metals, and Industrial Transportation

Bottom 3 sectoral indices: Travel, Automotive, and Fossil Fuels

Crude oil prices: Brent crude down 0.77% at $74.57/barrel; US WTI crude down 0.82% at $71.08/barrel

Gold prices: An ounce of gold traded at $1,786.25, up 0.08%

Exchange rate: GBP vs USD - 1.3258, down 0.09% | GBP vs EUR - 1.1745, up 0.16%

Bond yields: US 10-Year Treasury yield - 1.448% | UK 10-Year Government Bond yield - 0.7095%

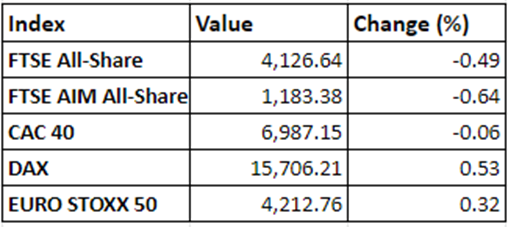

Markets @ 14:36 GMT

© 2021 Kalkine Media®

.jpg)