UK Market: The UK stock market picked up the pace on Wednesday, with the blue-chip FTSE 100 index moving up by 0.75%. Solid results from the paper and packaging firm Smurfit Kappa Group (2.45%) lifted the entire sector and many packaging companies were in demand, DS Smith Plc (2.96%), Mondi Plc (4.12%).

Ceres Power Holdings Plc (LON: CWR): Leading alternative fuel company was up by over 27%, with a day’s high of GBX 662 after the company announced that it has signed a non-binding three-way collaboration agreement with Weichai Power and Robert Bosch GmbH to explore for fuel cell growth opportunities in the Chinese market.

Micro Focus International Plc (LON: MCRO): The enterprise software provider was up by over 9%, with a day’s high of GBX 444.80. The stock has been in demand after the company recently announced its full-year results. The company reported total revenue of USD 2.9 billion for the year ended 31 October 2021. Also, it declared a final dividend of 20.3c per share.

Menzies (John) Plc (LON: MNZS): The international aviation services provider was up by 36%, with a day’s high of GBX 475 after the company rejected the unsolicited acquisition proposal from the National Aviation Services Holding.

US Markets: The US market is likely to open in green as indicated by the futures indices. S&P 500 future was up by 42 points or 0.94% at 4,554, while the Dow Jones 30 futures was higher by 0.71% or 252 points at 35,592. The technology-heavy index Nasdaq Composite future was up by 1.25% at 14,919 (At the time of writing – 8:50 AM ET).

US Market News:

The cannabis company, Canopy Growth (CGC), was up by over 6% in premarket trading after the company reported better than expected quarterly results. The company’s higher revenue was mainly due to sales growth in drinks and vapes related products.

The solar and battery systems maker, Enphase Energy (ENPH), was up by over 20% in premarket trading after the company’s quarterly result beat the market estimates. The total group revenue improved during the period.

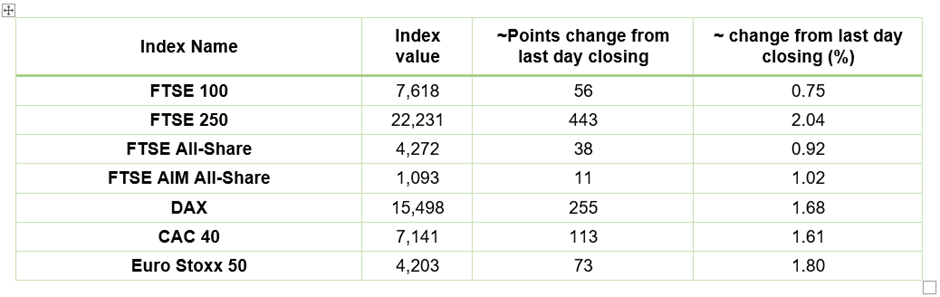

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 09 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), International Consolidated Airlines Group (IAG), Vodafone Group Plc (VOD)

Top 3 Sectors traded in green*: Consumer Cyclicals (1.93%), Industrials (1.85%), Real Estate (1.80%)

Top Sector traded in red*: Healthcare (-0.14%)

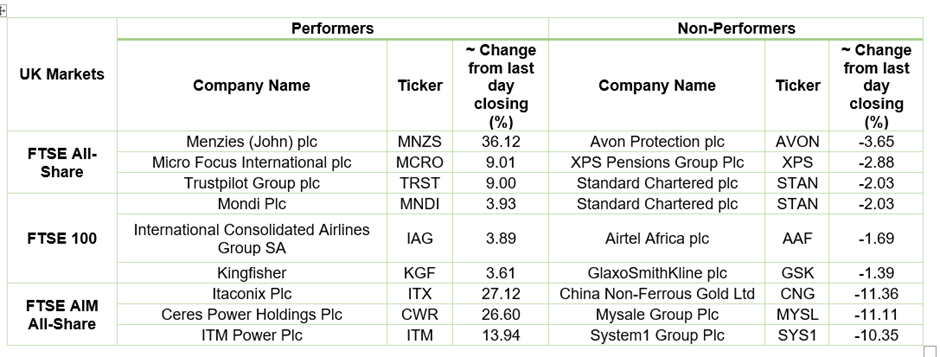

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $90.84/barrel and $89.35/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,828 per ounce, up by 0.02% against the prior day closing.

Currency Rates*: GBP to USD: 1.3579; EUR to USD: 1.1435.

Bond Yields*: US 10-Year Treasury yield: 1.941%; UK 10-Year Government Bond yield: 1.4490%.

*At the time of writing

.jpg)