UK stock markets are likely to open on a negative footing on Monday, 11 January, as investors have turned cautious ahead of the macroeconomic data release and the beginning of corporate result season for the fourth quarter of FY 2020-21. Balance of trade, three-month average of GDP, industrial production, and manufacturing production are some of the key economic points that are set to be released on Friday.

Focus on London equities

A mixed-bag trading session in Asian equities coupled with the uncertainty cloud over the size of fiscal stimulus by the Washington administration have kept the market participants on the edge. Dow Industrials and Nasdaq Composite finished at lifetime highs on Friday, while the domestic barometer FTSE 100 concluded at a 10-month high after rising consecutively for the first five days of new year 2021.

As per data with the London Stock Exchange, FTSE 100 gained 16.30 points, or 0.24 per cent to end at 6,873.26 on Friday, registering a first week gain of 6.39 per cent. The broader market indices FTSE 250, FTSE 350, and FTSE All-Share surged 2.8 to 5.8 per cent in the corresponding stretch with FTSE 350 leading the charge among the major stock indices of the exchange.

Testing times ahead

It will be crucial to see how the ongoing vaccination drive in the United Kingdom is going to help in reducing the pressure on the NHS with the country expanding the asymptomatic Covid-19 testing. The distribution of recently approved Moderna vaccine is expected to bolster the inoculation number, subsequently helping in decreasing the count of hospital admissions.

Any further clarity from the Chancellor of the Exchequer with regards to fiscal measures other than the lockdown grants of £4.6 billion will help in restoring the seemingly lost confidence among the investors. The corporate number, guidance for upcoming quarters, and dividend announcements are likely to provide a material direction to the London equities in the near future.

GBP slips as USD gains strength

The Great Britain pound (GBP) vs United States dollar (USD) traded in red after opening largely flat. The GBP to USD pair was trading at 1.3506, down 0.42 per cent, at around 0642 GMT, from the previous close of 1.3563. The currency pair has oscillated between 1.3492 and 1.3568 during the day so far. The Bank of England had fixed a reference foreign exchange rate of 1.3544 USD and 1.1048 EUR against a unit of pound sterling on 7 January.

GBP vs USD (11 Jan)

(Source: Refinitiv, Thomson Reuters)

Gold, crude turn red

On the commodities front, gold lost its shine as the greenback strengthened against a basket of currencies on the renewed hopes of a big-ticket stimulus package. An ounce of yellow metal was trading at $1,844.41, down 0.27 per cent, from the previous closing of $1,849.44. Energy market retreated sharpy on Monday with a barrel of Brent crude oil trading 1.64 per cent lower at $55.07, while WTI crude shedding 1.13 per cent to $51.65 per barrel.

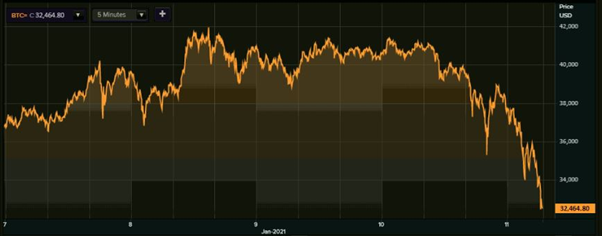

Bitcoin crashes 21%

Meanwhile, the cryptocurrency market has witnessed a steep setback with bitcoin tumbling nearly 21 per cent to a 24-hour low of around $32,500. According to the data available with Binance, bitcoin collapsed as much as 20.95 per cent to $32,538.31 from the 24-hour peak of $41,164.47. Bitcoin has made a lifetime high at 42,000.18.

Bitcoin (1-week)

(Source: Refinitiv, Thomson Reuters)