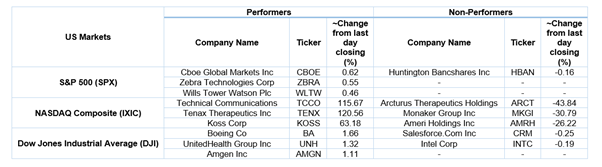

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 5.13 points or 0.14 per cent higher at 3,740.49, Dow Jones Industrial Average Index surged by 60.26 points or 0.20 per cent higher at 30,464.23, and the technology benchmark index Nasdaq Composite traded lower at 12,871.09, down by 28.33 points or 0.22 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The major indices of Wall Street traded mixed due to the emerging investor confidence regarding the potential for a larger US stimulus package. Among the gaining stocks, shares of Barnes & Noble Education went up by around 7.41% after the company updated regarding its expense reduction. Lemonade grew by about 5.41% as 44 million shares of the company were eligible for sale. Boeing gained about 1.16% as American Airlines became the first U.S. carrier to return the updated 737 Max jet to service. Bausch Health Companies moved up by almost 0.70% after the company planned to pay down US$275 million of debt. Among the declining stocks, Arcturus Therapeutics Holdings shares dropped by about 40.27% after it released data regarding Covid-19 vaccine candidates.

US Stocks Performance*

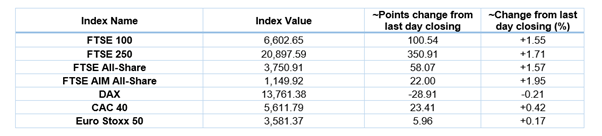

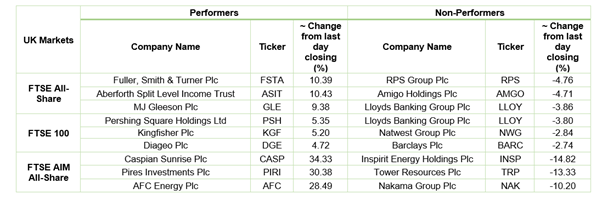

European News: The London and European markets traded in the green amid positive investors sentiments regarding the US stimulus package and UK’s Brexit trade deal. Britain received 22 deliveries of Pfizer/BioNTech Covid-19 vaccine by 25 December 2020. Among the gaining stocks, shares of Shearwater Group went up by nearly 9.32% after the company reported a positive third-quarter trading performance. Shares of AstraZeneca nudged up by almost 3.48% after the company said that its Lynparza treatment had been approved in Japan. Shares of Omega Diagnostics grew by around 3.23% after Abingdon Health provided an update regarding Covid-19 rapid test kit. Admiral gained by around 2.98% after the company announced the sale of Penguin Portals and Preminen comparison businesses to RVU. Among the decliners, Lloyds Banking Group plunged by about 4.17% due to the adverse reaction of the Brexit trade deal. William Hill fell by around 0.04% after the company updated its remaining approvals required from the US gaming authority.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 29 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Healthcare (+3.43%), Consumer Non-Cyclicals (+3.09%) and Industrials (+2.73%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $51.21/barrel and $47.95/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,882.85 per ounce, up by 0.13% against the prior day closing.

Currency Rates*: GBP to USD: 1.3485; EUR to GBP: 0.9076.

Bond Yields*: US 10-Year Treasury yield: 0.931%; UK 10-Year Government Bond yield: 0.211%.

*At the time of writing