UK Markets: London equities witnessed a moderate upsurge in the early hours of half-day session on Friday, 24 December, with the benchmark FTSE 100 hitting the highest level in the last 22 months. However, the market index finished largely unchanged after surrendering the gains in the terminal deals following the declines in heavyweight components. The index has effectively snapped the three-day rally, after gaining 1.41% in the current week.

The mounting Covid cases in the United Kingdom has kept the jittery alive with the country reporting a record high for daily infections. On 24 December, Christmas Eve itself, the government said 122,186 individuals have been tested positive for Covid-19. This is the fresh all-time high for Covid-19 infections since the beginning of pandemic. Earlier yesterday, the nation reported 119,789 cases. This has been the third day when the country has reported more than 100,000 cases.

US markets were closed on 24 December on account of Christmas holidays. Earlier yesterday, the broader S&P 500 registered a fresh record high of 4,743.83 after briefly breaching the previous high. Dow Jones Industrial Average soared nearly 196 points, while the tech heavy benchmark Nasdaq Composite added 131.48 points, or 0.85% to finish at 15,653.37 on Thursday, 23 December. Dow Industrials ended just shy of the psychological level of 36,000.

The South African study confirming the less severity of the Omicron variant categorically relieved the market participants as they continued to accumulate the shares before the commencement of fourth quarter and full year corporate earnings. The FTSE 100 blue-chip corporations are set to declare the October-December results from the second week of January 2022.

The trading figures of the present quarter are likely to reflect the partial impact of the Omicron variant with the businesses related to the hospitality and leisure sectors witnessing the major adversities of mask mandate, tightening of border control measures and worries surrounding the highly contagious nature of the new variant.

The first study by the government of the UK has complemented the findings of South African research with the UK Health Security Agency (UKHSA) saying that the chances of hospital admissions are up to 70% lower for the people infected with the Omicron variant as against the individuals who tested positive with the Delta variant of the Covid-19 (SARS-CoV-2) virus.

UK Market News: Shares of B&M European Retail, Sage Group, International Consolidated Airlines, Pershing Square Holdings, Ocado Group, Whitbread, InterContinental Hotels Group, BT Group, Pearson and Anglo American emerged as the lead gainers among the 101 components of the benchmark FTSE 100, with the stocks of rising 1-3%.

On the other hand, shares of Flutter Entertainment, BHP Group, Associated British Foods, and Antofagasta cracked 1-2%, partly counterbalancing the positive points provided by the aforementioned shares.

The top 10 heavyweight stocks ended on a flat note, barring the shares of Diageo and Glencore. With the evolving course pandemic, investors are still progressing with caution as Covid cases continue to climb.

The headline market index FTSE 100 ended 1.24 points, or 0.02% lower at 7,372.10, while the mid-cap barometer FTSE 250 finished 3.68 points, or 0.02% higher at 23,270.43. In the last four sessions, FTSE 100 has amassed a gain of little more than 2.40%. In the present calendar year so far, the market index has registered a rise of 800.22 points, or 12.18% to 7,372.10, from the level of 6,571.88. With the present momentum in the markets, the domestic benchmark can oscillate in any direction in the remainder of 2021.

FTSE 100 (24 December)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and BP

Top 3 sectoral indices: Construction, Software and Computing, and Precious Metals

Bottom 3 sectoral indices: Industrial Engineering, Food Products and Electronic & Electrical Equipment

Crude oil prices: Brent crude down 0.10% at $76.52/barrel; US WTI crude up 1.32% at $73.72/barrel

Gold prices: An ounce of gold traded at $1,810.10, up 0.01%

Exchange rate: GBP vs USD - 1.3397, down 0.05% | GBP vs EUR - 1.1844, up 0.08%

Bond yields: US 10-Year Treasury yield - 1.493% | UK 10-Year Government Bond yield - 0.9220%

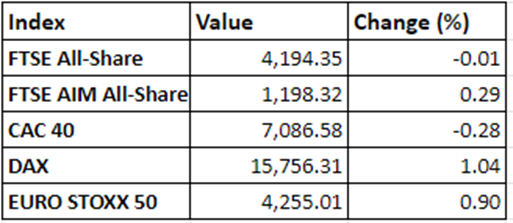

Markets @ 16:30 GMT

© 2021 Kalkine Media®