US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 4.02 points or 0.09 per cent lower at 4,432.50, Dow Jones Industrial Average Index dipped by 65.59 points or 0.19 per cent lower at 35,142.92, and the technology benchmark index Nasdaq Composite traded higher at 14,853.80, up by 18.00 points or 0.12 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note amid investors’ worries regarding the delta variant of coronavirus. Among the gaining stocks, Sanderson Farms (SAFM) shares rose by about 7.27% after the Company got ready to be acquired in a lucrative deal worth approximately USD 4.50 billion. Tesla (TSLA) shares grew by about 2.14% after Jefferies had upgraded the stock from “Hold” to “Buy”. Among the declining stocks, Veoneer (VNE) shares went down by around 1.78% after the Company stated that it would begin a discussion with Qualcomm regarding the takeover deal. Dollar Tree (DLTR) shares dropped by about 0.29% after Deutsche Bank had downgraded the Company to “Hold”.

UK Market News: The London markets traded on a mixed note after a significant drop in gold and crude oil price due to the rising coronavirus cases of the delta variant.

FTSE 100 listed SSE shares surged by about 4.85%, boosted by the media reports over the weekend that Elliot Management had built up a stake in the Company. Moreover, it remained the top performer on the FTSE 100 index.

Vectura Group shares climbed by around 5.49% after PMI Global Services had increased the cash offer for the Company to 1.02 billion pounds.

Deliveroo surged after media reports that the German rival Delivery Hero had purchased a 5.09% stake in the Company. Furthermore, the shares grew by around 4.40%.

PageGroup shares dropped by around 3.36%, although the Company had swung into interim profit and subsequently declared a special dividend. However, the business performance took a hit last year due to the adverse impact of the Covid-19 pandemic.

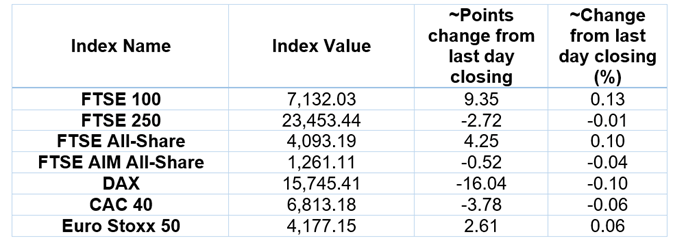

European Indices Performance (at the time of writing):

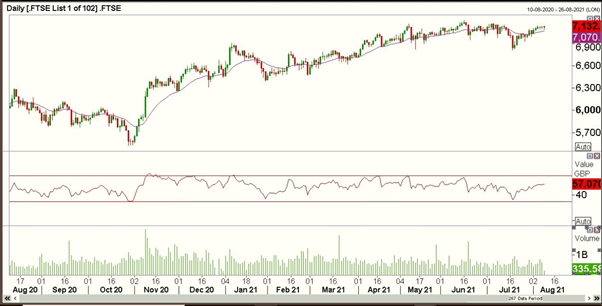

FTSE 100 Index One Year Performance (as on 9 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); BP Plc (BP.).

Top 3 Sectors traded in green*: Utilities (+1.95%), Healthcare (+0.52%) and Consumer Non-Cyclicals (+0.35%).

Top 3 Sectors traded in red*: Energy (-0.85%), Real Estate (-0.47%) and Consumer Cyclicals (-0.34%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.60/barrel and $65.97/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,731.75 per ounce, down by 1.78% against the prior day closing.

Currency Rates*: GBP to USD: 1.3855; EUR to GBP: 0.8478.

Bond Yields*: US 10-Year Treasury yield: 1.317%; UK 10-Year Government Bond yield: 0.5870%.

*At the time of writing