US Markets: The early morning trends in the futures signals a slightly negative opening for the US stock market. S&P 500 future was down by 4 points or 0.09% at 4,768, while the Dow Jones 30 futures was down by 0.15% or 52 points at 36,242. The technology-heavy index Nasdaq Composite future was down by 0.04% at 16,437 (At the time of writing – 8:50 AM ET).

US Market News: Shares of the medical technology company Colfax (CFX) was down by 2.7% in premarket trading after the company said it is planning a shareholder meet to approve a reverse stock split.

The shares of the pharma company Lexicon Pharmaceuticals (LXRX) were up by 6.5% in premarket after the company submitted a new drug application (NDA) to US-FDA for its new drug that reduces the risk of heart failure in diabetic patients.

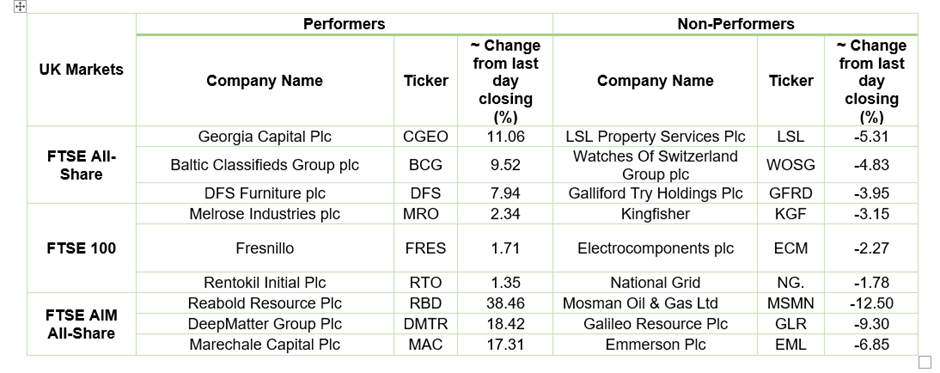

UK Market News: The UK stock market ended the final trading session of 2021 in the red as the benchmark index FTSE100 declined by 0.25% to close at 7,384. Overall, the stock market gave a good year, with the benchmark index, FTSE100 rallying 14% during the year.

Mosman Oil & Gas Ltd (LON:MSMN): Shares of the oil and gas exploration company was down by 12.50%, with a day’s low of GBX 0.07 after the company proposed to conduct a consolidation to reduce the number of shares on issue.

Georgia Capital Plc (LON: CGEO): Shares on the investment company was up by 11.06%, with a day’s high of GBX 716 after the company announced that its subsidiary, JSC Georgia Capital, has agreed to sell an initial 80% of its equity in the water utility business.

Kingfisher Plc (LON: KGF): Shares of the home improvement company were down by 3.15%, with a day’s low of GBX 338.30. The stock saw profit booking from investors. However, the share price has been up by 6.79% since 1 December 2021.

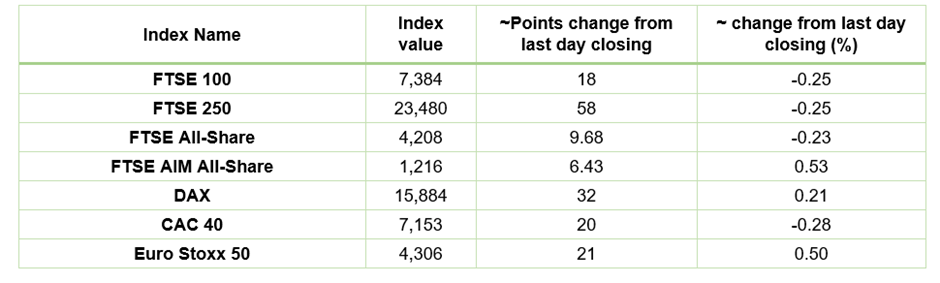

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 31 December 2021)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP Plc (BP.)

Top Sector traded in green*: Real Estate (0.32%)

Top 3 Sectors traded in red*: Utilities (-1.15%), Industrials (-0.36%), Consumer Non-Cyclicals (-0.23%),

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $78.39/barrel and $75.72/barrel, respectively.

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $78.39/barrel and $75.72/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,820 per ounce, up by 0.37% against the prior day closing.

Currency Rates*: GBP to USD: 1.3507; EUR to USD: 1.1353.

Bond Yields*: US 10-Year Treasury yield: 1.505%; UK 10-Year Government Bond yield: 0.9690%.

*At the time of writing