It has been an eventful start to the new year 2021 with global financial markets rejoicing the onset of the recovery period, after witnessing a never-seen-before crisis due to the still-evolving Covid-19 (CoV-2-SARS) virus. Following the first full trading week after a couple of holiday-truncated sessions, America’s two of the most-tracked stock indices Dow Industrials, and Nasdaq registered all-new record highs.

(Image source: ©Kalkine Group 2020)

Bitcoin tops $42,000

Interestingly, the most-popular cryptocurrency bitcoin also broke several records in the nine-day trading on the cryptocurrency exchange so far. Bitcoin has briefly breached the psychological level of $42,000 on 8 January hitting an all-time high of $42,000.18, Binance data showed. In the present year itself, bitcoin has leapfrogged nearly $13,000 to reach a level above $40,000.

(Source: Refinitiv, Thomson Reuters)

Bitcoin has largely risen for most of the days in the past four months with the crypto-asset quadrupling to over $42,000 from the levels around $10,000 in early September. Many experts have predicted further gains in the cryptocurrency market as a section of market participants are now considering bitcoin as a potential alternative to gold and the United States dollar in hedging their respective portfolios against inflation.

While, the outlook of central banks, capital market regulators and almost all the government remain bleak with regard to the usage and distribution of cryptocurrencies. Gauging the true value of the underlying asset, financial crimes, unconditional volatility, and non-regulated market are some of the limitations and potential risks of dealing in crypto-assets.

DJIA, Nasdaq finish at records

The New York Stock Exchange-controlled Dow Jones Industrial Average (DJIA) has advanced 491.49 points, or 1.61 per cent to a lifetime closing peak of 31,097.97 (8 January) from the level of 30,606.48, while the Nasdaq Composite gained 313.70 points, or 2.43 per cent to end at a record closing high of 13,201.98 from the level of 12,888.28 as on 31 December 2020.

US equities bounced back invariably after slipping on the first trading day of 2021. The Democratic party confirming the victory in Georgia over the Republican counterpart coupled with the hopes of a higher Covid-19 relief package from the Biden administration sent the markets to a flying start.

(Source: Refinitiv, Thomson Reuters)

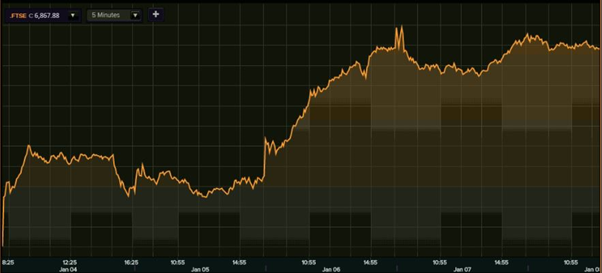

FTSE 100 @ 10-month high

With the considerable gains in the very first week of the new year, global stock indices followed Wall Street with the domestic benchmark FTSE 100 amassing a gain of more than 6 per cent. The ongoing vaccine programme in the United Kingdom also bolstered the investors’ confidence, negating the worries over the third national lockdown.

The UK’s drug regulator approving Moderna’s Covid-19 vaccine guided the London equities to post five straight sessions of gains. According to the data available with London Stock Exchange, the headline FTSE 100 jumped as much as 412.74 points, or 6.39 per cent to a fresh 10-month high of 6,873.26 from a level of 6,460.52 as on 31 December 2020.

(Source: Refinitiv, Thomson Reuters)

Global stock market rally

Meanwhile, the stock markets across the globe rallied in a largely similar fashion tracking the upbeat Wall Street. Japan’s Nikkei 225 gained 2.53 per cent, France’s CAC 40 soared 2.80 per cent, Germany’s DAX surged 2.41 per cent, Switzerland’s SMI added 1.03 per cent, Spain’s IBEX 35 surged 4.1 per cent, Italy’s FTSE MIB clinched 2.52 per cent, China’s Shanghai Composite gained 2.79 per cent, Hong Kong’s Hang Seng added 2.38 per cent, India’s Nifty 50 rose 2.61 per cent, while South Korea’s Kospi surged 9.70 per cent.