UK stock markets have steadily bounced back from the pandemic-steered bottoms with the FTSE 100 picking itself from the dismantled levels recognised during the February-March period last year. After four consecutive days of gain, the benchmark FTSE 100 index has turned range bound on 8 January. With the paralytic condition of the benchmark index seemingly indicating towards a next driving force that can materially steer the market direction in the upcoming weeks.

The FTSE 100 snapped the last trading day of the week higher by 0.24 per cent at 6,873.26 from the previous close. With multiple things affecting the markets, we take a look at some touching points with regard to the London equities.

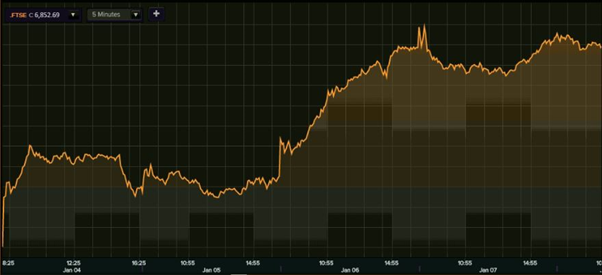

FTSE 100 (1-week)

(Source: Refinitiv, Thomson Reuters)

Markets & Capitol Hill drama

The first week of the New Year witnessed some of the extreme moments with the FTSE 100 reclaiming a 10-month high level even after the announcement of national lockdown. The Capitol Hill drama apparently orchestrated by the Trump supporters seemed to have failed in affecting the market sentiments.

The storm was quickly normalised by the authorities restoring calm, however, the House of Representatives and the Senate were forced to terminate the discussions over the congressional ceremony of President-elect Joe Biden. A Wall Street guided rally was observed in the global markets on the possibilities of a large quantum economic stimulus from the Democratic party-favoured Biden administration.

After the situation got normalised, the NYSE-controlled Dow Jones Industrial Average (DJIA) and the tech-heavy Nasdaq Composite registered respective record highs, while back in London, the headline FTSE 100 marked the fourth consecutive day of gains.

Fiscal stimulus optimism

A big-ticket relief package announcement from the US government can develop a certain chance of a similar move by the Downing Street administration.

If the US government announces a big ticket relief package, a similar move can be expected from the Downing Street administration. The Chancellor of the Exchequer Rishi Sunak has, however, announced that the lockdown grants stood at £4.6 billion per day after PM Boris Johnson declared the third national lockdown.

With the seven-week nationwide lockdown in place, the market participants will be certainly eyeing for another booster from the government that can ascertain industry-specific allocations and a comprehensive job support programme for the workers that are not entitled to receive any benefit from the extended furlough scheme.

Vaccination

The rising cases due to the newly mutated strain of the virus and the already existing component of the CoV-2-SARS virus is going to have a material impact on the economic growth of the country. Repeated disruption in the air travel, cross-border freight movement, and shutdown of major hospitality venues have certainly disheartened the businesses as well as the investors.

The ongoing vaccination drive with the availability of three approved coronavirus vaccines and the cumulative efforts of local authorities and the NHS are likely to play a vital role in reducing the pressure on the healthcare system. A substantial drop in the hospital admissions following the reduced count of new infections on a daily basis can help the government in analysing whether it can lift the national lockdown before the scheduled deadline of review.

Corporate results & macro data

Going ahead in the quarter, the upcoming financial results of the companies and the macroeconomic data scheduled to be announced is likely to provide a concrete direction to the equities and the stance of investors. Investors are likely to stay glued to the guidance provided by the heavyweight corporations during the results declaration period, while any surprises in the form of dividends, or bonuses are likely to be welcomed. The entities that are on the track of posting a higher-than-expected operating profit are likely to emerge as the top performers of the year ahead.