Summary

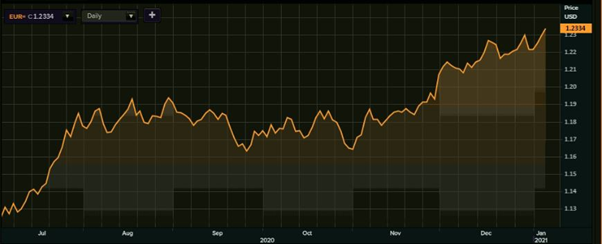

- The EUR vs USD pair has been trading at a 52-week high on Wednesday

- The persisting weakness in greenback has lifted many European, as well as global currencies

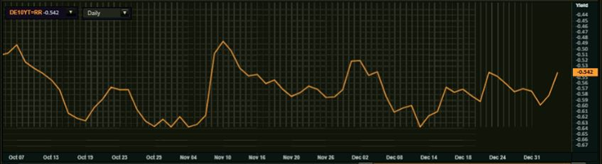

- Germany’s 10-year bond yields are hovering at a 5-week high on 6 January

The euro has extended the gains against the United States dollar (USD) on Wednesday, 6 January, ahead of the scheduled release of Eurozone PMI on Thursday. The persisting weakness of the greenback has certainly aided to the strength of euro and pound sterling in the recent past.

European stocks leading the gains on Wednesday also lifted the prospects of the euro with the market participants eyeing for a bigger relief package by the Washington administration following the Democratic win in US Senate elections. The euro has been on a rising run over the last 12-month stretch with Europe’s most followed currency advancing a little more than 10 basis points against the greenback.

Most of the European nations are mulling to extend or announce national lockdowns in the near future to contain the rising spread of coronavirus in the continent. With Britain leading the charge following a seven-week nation-wide lockdown and Germany extending its lockdown until the end of January, the overall market prospects have weakened as compared to a two-week old period.

EUR gains strength vs USD

As per the latest data available with the Reuters, the EUR vs USD pair was trading at 1.2337, up 0.35 per cent from the previous close of 1.2294. As per the historical foreign exchange data, a unit of euro equalled a 52-week high of 1.2349 US dollars on 6 January subsequent to the successive gains recognised in the last six months.

The EUR vs USD currency pair had concluded at 1.1272 at the interbank foreign exchange market on 7 July 2020. The European Central Bank had fixed a reference exchange rate of 1.2271 USD against a unit of euro on 5 January 2021.

EUR vs USD (6 Jan)

(Source: Refinitiv, Thomson Reuters)

EUR vs USD (6-month performance)

(Source: Refinitiv, Thomson Reuters)

It is the highest reference exchange rate fixed by the ECB in at least 32 months. Three years earlier on 15 February 2018, the ECB had fixed a currency conversion rate of 1.2493 USD vs a unit of EUR. The greenback has plunged to a nearly three-year low against the euro and has registered a six-year low against Swiss franc on 5 January.

Germany’s bond yield @ 5-week high

Meanwhile, Germany’s 10-year bond yields have risen to a five-week high on 5 January tracking the upbeat currency against the greenback. The US 10-year Treasury yield leaping above 1 per cent for the first time in the last 10 months also bolstered the gains of Germany’s 10-year bond yields. With the latest data available with the Reuters, Germany’s 10-year bond yield jumped to a five-week peak of -0.53 per cent.

Germany’s 10-year bond yields

(Source: Refinitiv, Thomson Reuters)