US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 10.88 points or 0.25 per cent higher at 4,311.80, Dow Jones Industrial Average Index surged by 80.39 points or 0.23 per cent higher at 34,582.90, and the technology benchmark index Nasdaq Composite traded lower at 14,488.90, down by 15.00 points or 0.10 per cent against the previous day close (at the time of writing – 12:05 PM ET).

US Market News: The major indices of Wall Street traded on a mixed note as energy stocks surged, driven by a spike in oil price. Among the gaining stocks, Didi Global (DIDI) shares surged by about 14.29% after the Company made its US debut yesterday. Among the declining stocks, CureVac (CVAC) shares plummeted by around 8.00% after the final study analysis revealed its Covid-19 vaccine to be 48% effective. Atotech (ATC) shares dropped by about 1.00% after the Company got agreed to be acquired by MKS Instruments. McCormick (MKC) shares went down by about 0.86%, although the Company’s quarterly earnings came out to be more than the consensus estimates.

UK Market News: The London markets traded in a green zone after well-received corporate updates coming from heavyweight companies. Moreover, the IHS Markit/CIPS UK Manufacturing Purchasing Managers’ Index had dipped to 63.9 during June 2021, while it was a record 65.6 in May 2021.

JD Sports Fashion shares surged by about 5.18% after it remained on track to deliver annual profits of at least 550 million pounds. Moreover, the Company had decided to pay back government furlough support.

FTSE 100 listed Associated British Foods stated that it had expected annual profit to remain in line with the prior year boosted by the encouraging business performance of Primark stores during the third quarter. Moreover, the shares went up by approximately 3.70%.

AO World shares dropped by around 3.08%, even after the Company had reported outstanding growth in top-line profit and bottom-line profitability during FY21 driven by a boom in online sales.

Micro Focus International shares plunged by around 13.51% after the Company had reported a significant drop in revenue and profitability during the six months period ended on 30 April 2021.

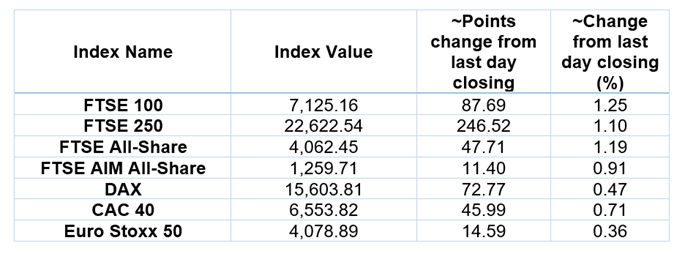

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 1 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc. (RR.).

Top 3 Sectors traded in green*: Energy (+2.43%), Consumer Cyclicals (+1.86%) and Industrials (+1.50%).

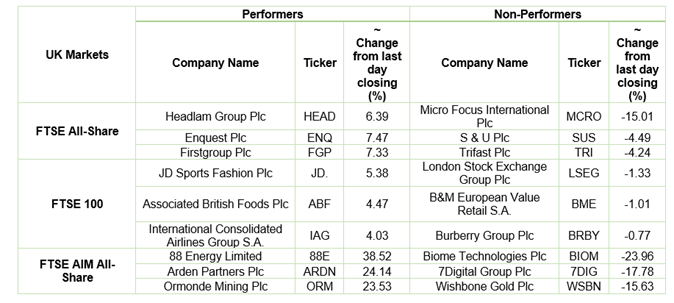

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $75.57/barrel and $74.88/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,773.65 per ounce, up by 0.12% against the prior day closing.

Currency Rates*: GBP to USD: 1.3761; EUR to GBP: 0.8608.

Bond Yields*: US 10-Year Treasury yield: 1.480%; UK 10-Year Government Bond yield: 0.7280%.

*At the time of writing