US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 16.58 points or 0.37 per cent higher at 4,540.67, Dow Jones Industrial Average Index surged by 157.65 points or 0.45 per cent higher at 35,470.18, and the technology benchmark index Nasdaq Composite traded higher at 15,360.00, up by 50.60 points or 0.33 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a green zone after the release of the impressive jobless claims data. Among the gaining stocks, ChargePoint Holdings (CHPT) shares rose by around 7.96% after the electrical vehicles charging company had raised full-year revenue guidance. Ciena (CIEN) shares surged by around 0.81% after Company’s quarterly earnings came out to be 13 cents ahead of the consensus estimates. Among the declining stocks, Chewy (CHWY) shares fell by about 8.66% after the Company reported quarterly loss more than the estimates. Hormel Foods (HRL) shares dropped by around 4.90% after the Company had given a weaker-than-expected full-year outlook.

UK Market News: The London markets traded on a mixed note as investors eyed for fresh growth catalysts. Moreover, crude oil prices drove higher, benefitted by the reduction in US jobless claims and a decline in US reserves.

Melrose Industries shares surged by about 6.60% after the Company stated that the trading remained well ahead of the expectations with lower debt. Moreover, the Company had reinstated interim dividend payments.

CMC Markets shares plunged by around 27.48% after the Company had reported subdued market activity during July and August 2021. Furthermore, the year-to-date client income retention remained below the target of 80%.

Energean had reported first-half average working interest production ahead of the guidance. Moreover, the shares climbed by around 7.81%.

Barratt Developments shares went down by around 5.04% after the Company had reported a noticeable drop in net private reservations per active outlet per average week from 1 July through to 22 August 2021 when compared with an equivalent period of the prior year.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); BP PLC (BP).

Top 3 Sectors traded in green*: Energy (+2.07%), Healthcare (+0.55%), Financials (+0.29%).

Top 3 Sectors traded in red*: Basic Materials (-1.19%), Technology (-1.04%) and Consumer Cyclicals (-0.80%).

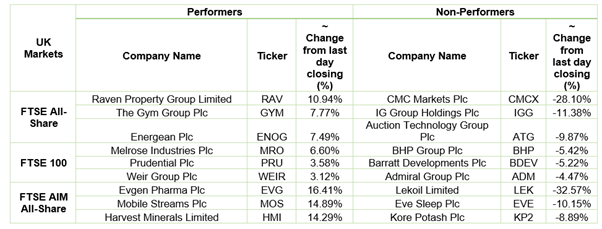

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $73.04/barrel and $70.05/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,811.35 per ounce, down by 0.26% against the prior day closing.

Currency Rates*: GBP to USD: 1.3832; EUR to USD: 1.1871.

Bond Yields*: US 10-Year Treasury yield: 1.294%; UK 10-Year Government Bond yield: 0.6780%.

*At the time of writing