US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 33.77 points or 0.95 per cent lower at 3,516.73, Dow Jones Industrial Average Index dipped by 6.89 points or 0.02 per cent lower at 29,151.08, and the technology benchmark index Nasdaq Composite traded lower at 11,436.40, down by 277.38 points or 2.37 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The Wall Street traded in the green as experts say that the V-shaped recovery is on track following hopes on vaccines and win of Joe Biden. The US NFIB Small Business Optimism was 104.0, and it was above the forecast of 102.2. Among the gaining stocks, Biontech gained around 3.3% after the company highlighted that its covid-19 vaccine is almost 90% effective. DR Horton was up by close to 3.0% after it raised dividend and highlights healthy 2021 outlook. Among the decliners, shares of Cyberark Software plunged by 8.1% as it reported revenue below consensus. Amazon was down by around 3.3% after EU hits it with anti-trust laws. Advance Auto Parts fell by about 1.5% as it reported adjusted quarterly earnings of USD 2.81 per share.

US Stocks Performance*

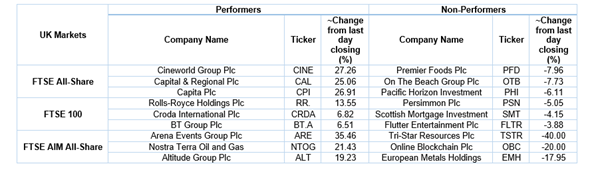

European News: The London and European markets gained on Tuesday. The British Prime minister, Boris Johnson got defeated in parliament on treaty breaking Brexit laws. Meanwhile, the UK reported an unemployment rate of 4.8% in September 2020 that was in-line with expectation. Among the gaining stocks, Rolls Royce gained the most on the FTSE-100 as it was up by around 14.1%. Croda International rose by approximately 6.2% after it announced the contract for an innovative delivery system for the covid-19 vaccine. Shares of Land Securities nudged up by about 5.9% after it reported revenue profit of £115 million in H1 FY21. NatWest moved up by nearly 4.2% after it priced the £1.0 billion notes. Among the decliners, Scottish Mortgage was down by close to 5.0% on the FTSE-100 index. Persimmon was down by around 3.4%, although it reported a strong performance in the third quarter.

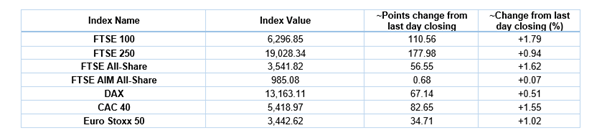

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 10 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Energy (+2.86%), Healthcare (+2.34%) and Basic Materials (+2.05%).

Top Sector traded in red*: Consumer Cyclicals (-0.11%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $43.31/barrel and $41.16/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,878.65 per ounce, up by 1.31% against the prior day closing.

Currency Rates*: GBP to USD: 1.3245; EUR to GBP: 0.8923.

Bond Yields*: US 10-Year Treasury yield: 0.958%; UK 10-Year Government Bond yield: 0.394%.

*At the time of writing