Summary

- House property prices in the British countryside have hit a four-year high with Worcester and Cobham witnessing the highest buyer traffic

- According to data provided by real estate agent Knight Frank LLP, the Prime Country House Index, for the one-year period ending September, rose by 2.3 per cent -- which is highest since March 2016

- Among the major reasons for the spike in demand for country houses is the stamp duty holiday announced by the government. Also, people want to move away from large cities to avoid being infected by the pandemic virus

There has been a big upward swing in the prices of rural properties in the United Kingdom. Real estate consultant Knight Frank LLC, which maintains an index called Prime Country House Index, has reported that it has witnessed a price rise of 2.3 per cent in one year to September, the highest growth since March 2016.

While the fear of the pandemic is the underlying impetus, the stamp duty holiday announced by the government till March 2021 is the major reason for the mad rush to buy countryside properties. It is, however, being suspected that the price hike has been instigated more by the property developers and agents who are cashing on the government stamp duty incentive. It will be interesting to see how the price and demand work once the government incentive is withdrawn in March 2021.

Fuelling demand

As per the house prices information provided by Knight Frank, the prices of country houses in west midlands have risen by an average of 3.7 per cent, which is led by Worcester. The prices in North Surrey have increased by an average of 3.1 per cent, where Cobham, Ascot, Esher and Weybridge are leading the race.

The real estate consulting firm further reported that for properties costing below £1 million, prices have risen by an average of 1.8 per cent. For properties costing more than £1 million, prices have increased by an average of 2.3 per cent, however, for properties ranging between £3 and £4 million, prices have increased by an average of 2.9 per cent for the quarter ending September compared to the preceding quarter.

Pandemic’s impact

People have become highly skeptical about coming out of their houses and joining work since the pandemic broke out in the country. The lockdown period prompted many companies to ask people to work from home.

In the last five months, most people have become comfortable in this working arrangement and are not willing to take a risk by venturing out. Moreover, people are also taking this as an opportunity to move back to suburban areas where the risk of catching the infection is relatively lower and the quality of life and air is better.

Go online

A significant amount of work and business was made possible because of the internet.

People not only used the internet to get their provisions home delivered but they also kept their work and business going as usual. The internet has, in the guise of this pandemic, showed us a new way to live and work and also given us a glimpse of how the future might look like. Better quality life, low per capita carbon emission, low per capita energy consumption are some of the implied benefits that work from home facility.

The work from home facility, however, has benefited the British economy in many ways.

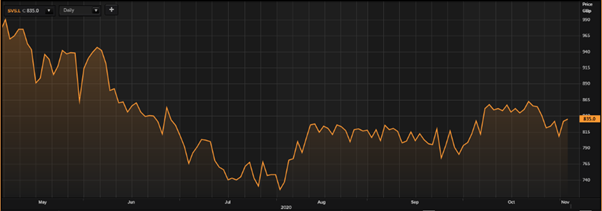

Savills plc

Savills plc (LON:SVS) has experienced a spike in the number of registrations in its country offices outside of London in July as compared to July 2019. The company is currently faced with a lack of stock of houses to meet the current demand.

Source- Thomson Reuters (six- months performance)

As on 04 November, the shares of Savills plc have been trading at £836.00 per share (3.16 PM GMT+1) gaining 0.6 per cent over the previous day’s close.