Highlights

Deliveroo’s board accepted a takeover bid from DoorDash, excluding major stake from voting deliberations.

The merger will combine operations across dozens of countries, serving around fifty million monthly users.

Independent committee and advisers reviewed the deal to maintain corporate governance and transparency.

The online food delivery sector has evolved significantly with the rise of digital ordering platforms. Within this changing landscape, Deliveroo PLC, listed on the FTSE 250 index, and DoorDash Inc., part of the NYSE, have advanced a merger agreement that may influence competitive dynamics. The development has attracted attention from those tracking the broader food service and e-commerce industry, especially within the context of major indices such as the ftse 100 live.

Deliveroo Board Decision and Valuation

Deliveroo’s board reached a decision to accept an acquisition proposal from DoorDash after comprehensive evaluation. The offer was reviewed by an independent committee formed without key stake including the founder and the representative of a major investment group. The committee evaluated the financial proposal to determine its alignment with company value metrics and long-term structural alignment. The agreed terms were consistent with prior communication between the two entities.

Cross-Border Strategic Integration

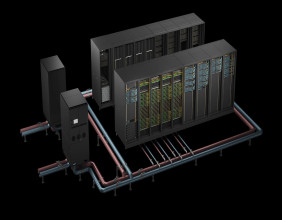

The combination of Deliveroo and DoorDash aims to integrate operations spanning multiple continents. This integration will establish a broad geographical footprint encompassing a wide variety of delivery markets. Collectively, the two platforms are set to reach tens of millions of users monthly across over forty countries. According to internal documentation, the proposal terms are presented as final, with provisions allowing for consideration of alternative offers should they arise.

Deliveroo's platform has established logistics and customer engagement capabilities across its served regions. These operational assets are seen as complementary to DoorDash’s global expansion approach, enabling the two companies to combine resources and delivery networks.

Market Positioning and Service Expansion

This merger is expected to enhance platform capabilities in terms of delivery speed, customer access, and merchant relationships. By joining operations, both companies intend to scale services and reinforce user experiences across existing and emerging markets. The collaboration is also designed to reduce redundancy and align technological infrastructure, offering improved consistency across customer interfaces.

This corporate alignment is consistent with industry consolidation trends seen globally, as companies seek to streamline operations in the face of competitive and logistical challenges. Mergers of this type are frequently employed to expand service footprints and improve access to technology-driven logistics models.

Governance and Transaction Oversight

Deliveroo formed an independent board committee specifically to assess the fairness of the offer. The review process was structured to exclude members with significant ownership or executive involvement to eliminate potential conflicts. External advisers provided additional scrutiny over valuation and transaction structure. This process underscores the role of corporate governance protocols in overseeing large-scale deals within listed companies.

The approach also reflects evolving practices in the governance of strategic acquisitions, where transparency and board independence play a central role in shaping outcomes aligned with broader stake interests.

Competitive Landscape Impact

This agreement may influence strategies within the online delivery and logistics sector. As companies adapt to digital transformation and consumer demand patterns, mergers have emerged as a method to gain scale and reduce fragmentation. Market participants may monitor this development to observe broader implications for global logistics networks, vendor integration, and user engagement strategies. The alignment of Deliveroo’s localized infrastructure with DoorDash’s growth priorities creates a combined presence that could influence regional service structures and supply chain ecosystems.

As industry structures evolve, references to this development may feature in updates tracking broader market movements, including insights tied to the ftse 100 live.