US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 16.80 points or 0.38 per cent lower at 4,451.20, Dow Jones Industrial Average Index dipped by 81.87 points or 0.23 per cent lower at 35,433.51, and the technology benchmark index Nasdaq Composite traded lower at 14,695.40, down by 127.50 points or 0.86 per cent against the previous day close (at the time of writing – 11:55 AM ET).

US Market News: The major indices of Wall Street traded in a red zone amid concerns over the slowdown in China. Among the gaining stocks, Sonos (SONO) shares surged by about 6.85% after the International Trade Commission judge had accused Google of infringing the Company’s audio technology patents. Seagate Technology Holdings (STX) shares rose by around 0.71% after UBS had upgraded the stock from “neutral” to “buy”. Hyatt Hotels Corp (H) shares went up by about 0.06% after the Company had announced the acquisition of Apple Leisure from the private equity firm KKR. Among the declining stocks, T-Mobile US (TMUS) shares slipped by around 3.10% after the Company had mentioned regarding a data breach incident that involves the personal data of over 100 million users.

UK Market News: The London markets traded in a red zone because of the weak performance of the mining stocks after the release of the disappointing Chinese data.

Future shares surged by about 4.99% after the Company had acquired consumer media player Dennis in a lucrative deal worth approximately 300 million pounds from Exponent Private Equity.

FTSE 250 listed Ultra Electronics shares grew by around 5.95% and remained the top performer on the index after the Company had agreed upon the takeover offer of 3,500 pence per share by the defence group Cobham.

BHP Group had confirmed the media speculation that the Company remained in discussions regarding a possible merger of the petroleum business with Australia’s Woodside Petroleum. Moreover, the shares dropped by around 2.33%.

Anglo Asian Mining shares went down by around 2.50%, although the Company came up with encouraging results from the maiden JORC Mineral Resource for the Zafar polymetallic deposit.

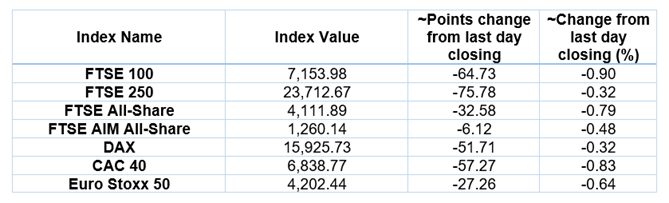

European Indices Performance (at the time of writing):

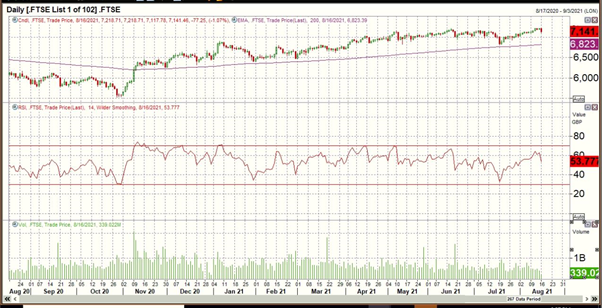

FTSE 100 Index One Year Performance (as on 16 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top Sector traded in green*: Healthcare (+0.25%).

Top 3 Sectors traded in red*: Energy (-2.50%), Basic Materials (-1.88%) and Financials (-1.38%).

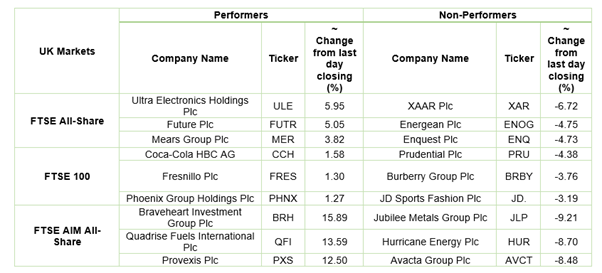

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.41/barrel and $66.94/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,788.95 per ounce, up by 0.60% against the prior day closing.

Currency Rates*: GBP to USD: 1.3843; EUR to GBP: 0.8508.

Bond Yields*: US 10-Year Treasury yield: 1.247%; UK 10-Year Government Bond yield: 0.5755%.

*At the time of writing