US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 14.07 points or 0.32 per cent higher at 4,414.34, Dow Jones Industrial Average Index dipped by 19.31 points or 0.06 per cent lower at 34,941.38, and the technology benchmark index Nasdaq Composite traded higher at 14,588.70, up by 62.80 points or 0.43 per cent against the previous day close (at the time of writing – 11:55 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note, reflecting investors’ worries regarding Federal Reserve tapering. Among the gaining stocks, Macy’s (M) shares surged by about 16.16% after the Company reported quarterly earnings more than the consensus estimates and raised the full-year guidance. Nvidia (NVDA) shares went up by about 7.27% after it had forecasted better-than-expected top-line revenue for the current quarter. Cisco Systems (CSCO) shares grew by around 1.10%, even after the Company’s current-quarter profit forecast remained lower than the consensus estimates due to the supply-chain issues. Among the declining stocks, Victoria’s Secret & Co (VSCO) shares plunged by around 4.88% after reporting quarterly sales less than the analysts’ expectations.

UK Market News: The London markets traded in a red zone after investors reacted to the tapering news indicating in the federal reserve meeting minutes.

Marshalls shares grew by about 4.69% after the Company had uplifted the expectations for 2021 and 2022 after reporting decent growth in first-half revenue and profitability supported by the government measures.

Gambling Company Rank Group shares plunged by around 5.24% after the Company had reported an operating loss of around 93 million pounds. Moreover, the Company got suffered from the Covid-19 restrictions as the venues remained closed.

FTSE 250 listed Helios Towers had shown decent revenue growth during H1 FY21. However, the Company had witnessed a drop in the operating profit. Moreover, the shares declined by around 5.11%.

Helium One Global shares surged by around 25.12% after the Company had commenced exploration drilling at Tai-2, the second exploration well targeting the Tai prospect.

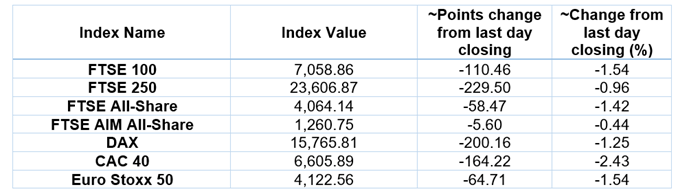

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 19 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); Glencore Plc (GLEN).

Top Sector traded in green*: Utilities (+0.46%).

Top 3 Sectors traded in red*: Energy (-3.83%), Basic Materials (-2.71%) and Financials (-1.84%).

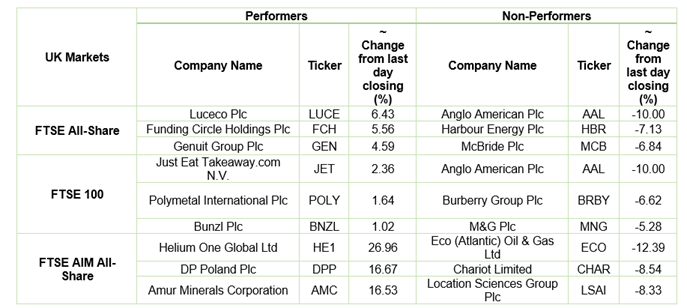

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $66.22/barrel and $63.22/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,780.70 per ounce, down by 0.21% against the prior day closing.

Currency Rates*: GBP to USD: 1.3644; EUR to GBP: 0.8558.

Bond Yields*: US 10-Year Treasury yield: 1.238%; UK 10-Year Government Bond yield: 0.5380%.

*At the time of writing